US Dollar Index: Sellers push harder and break below 106.00 ahead of PCE

- The index loses the grip further and breaches 106.00.

- Concerns around the US technical recession weigh on the dollar.

- The PCE and the final U-Mich Index will take centre stage later.

The US Dollar Index (DXY), which tracks the greenback vs. a bundle of its main rivals, extends the bearish note to the area below the 106.00 support on Friday.

US Dollar Index focuses on data, recession jitters

The index loses ground for the second session in a row and drops to new 3-week lows in the sub-106.00 region at the end of the week.

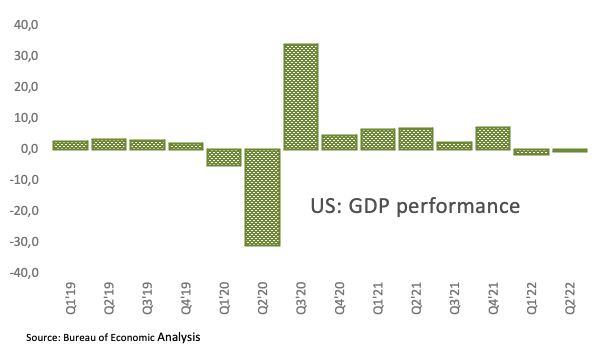

The better tone in the risk complex coupled with diminishing US yields continue to weigh on the buck, while investors continue to assess the recently published advanced Q2 GDP figures, which showed the US economy entering a technical recession.

In the US data sphere, the focus of attention is expected to be on the release of the inflation figures tracked by the PCE for the month of June along with the final Consumer Sentiment gauged by the U-Mich Index, Personal Income and Personal Spending.

What to look for around USD

The index accelerates the decline and breaches the 106.00 support to trade in fresh multi-week lows on Friday.

The very-near-term outlook for the dollar now looks deteriorated, particularly following the latest US GDP figures and the prospects for further tightening by the Fed in the next months.

In the meantime, the constructive view in the dollar still appears bolstered by the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: PCE Price Index, Personal Income, Personal Spending, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is down 0.52% at 105.64 and faces initial support at 104.72 (55-day SMA) followed by 103.67 (weekly low June 27) and finally 103.41 (weekly low June 16). On the other hand, a break above 107.42 (weekly high post-FOMC July 27) would expose 109.29 (2022 high July 15) and then 109.77 (monthly high September 2002).