NZD/USD Price Analysis: Bulls could be about to move in from critical daily support

- NZD/USD bears are taking control, but the bulls are holding up progress.

- The daily support could see a correction prior to a test of the dynamic support lower down.

NZD/USD is lower again in the Asian session as the week starts to draw to a close. Wednesday’s key day reversal has seen the bulls capitulate to the daily support structure as illustrated below:

NZD/USD daily chart

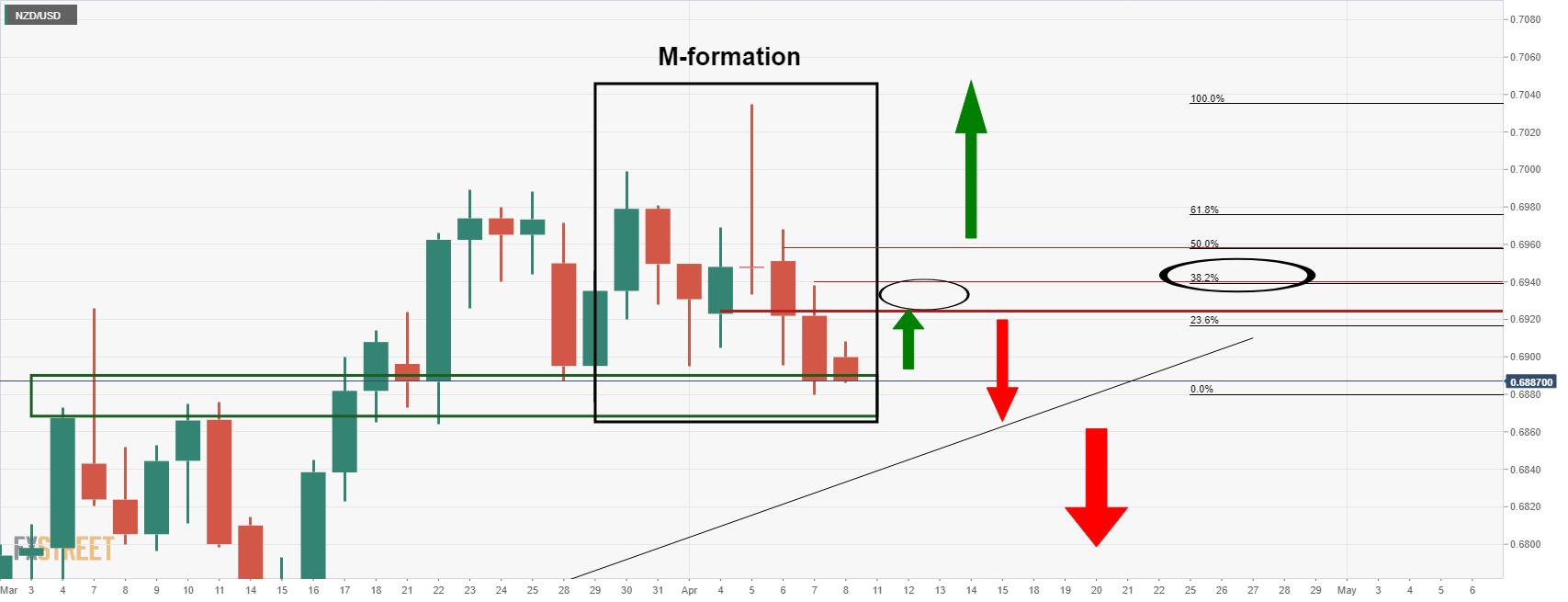

The price is testing the support zone once again which is the last defence for the dynamic trendline that guards a full-on breakout to the side. What is compelling, at this juncture, is the M-formation as per the close-up shot below:

The M-formation is a reversion pattern and considering the support area, the price would be expected to revert to test the neckline, if not the 38.2% or 50% rations. A break of the 50% mean reversion level would likely signify that the bulls will stay in control for longer and invalidate the topping structure, putting the breaks on the downside breakout thesis below the dynamic support.