US Dollar Index extends the downside to 94.30 ahead of key data

- DXY keeps correcting lower following cycle tops near 97.50.

- US yields remain side-lined below recent highs on Tuesday.

- Markets’ attention remains on the ISM Manufacturing.

The greenback, in terms of the US Dollar Index (DXY), extends the bearish move further south of the 97.00 mark on Tuesday.

US Dollar Index looks to risk trends, data

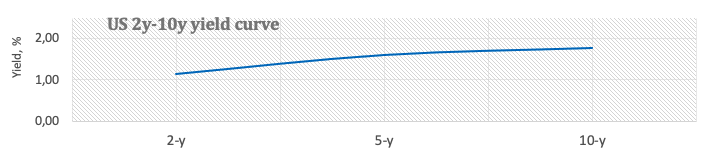

The index loses ground for the second session in a row so far on Tuesday on the back of the persistent improvement in the risk complex and further bear flattening of the US yield curve.

Indeed, the dollar came under pressure following last week’s fresh tops near 97.50, levels last traded in June 2020, as market participants continue to digest the hawkish message at the last FOMC event and recalibrate the potential Fed’s interest rate path and timing of the start of the balance runoff.

Comments from Atlanta Fed R.Bostic (2024 voter, dovish) also weighed on the buck on Monday after he practically ruled out a 50 bps rate hike in March. San Francisco Fed M.Daly (2024 voter, centrist) seemed to reinforce that view after she warned against tightening the policy too fast. Surprisingly, KC Fed E.George (voter, hawkish) advocated for a more aggressive action regarding the balance sheet, instead of focusing exclusively on the interest rate path.

In the US calendar, the always relevant ISM Manufacturing PMI is due later in the NA session seconded by Markit’s final Manufacturing PMI for the month of January.

What to look for around USD

The dollar’s corrective move remains well in place following recent 2022 peaks (January 28), always amidst the improved mood in the risk-associated universe and muted US yields. The sharp advance in the index in past sessions followed expectations that the Federal Reserve will start its hiking cycle and quantitative tightening in the relatively short-term horizon. Furthermore, the constructive outlook for the greenback is expected to remain unchanged for the time being on the back of rising yields, persistent elevated inflation, supportive Fedspeak and the solid pace of the US economic recovery.

Key events in the US this week: ISM Manufacturing, Final Manufacturing PMI (Tuesday) – ADP Employment Change (Wednesday) – Initial Jobless Claims, ISM Non-Manufacturing PMI, Factory Orders (Thursday) – Nonfarm Payrolls, Unemployment Rate (Friday).

Eminent issues on the back boiler: Fed’s rate path this year. US-China trade conflict under the Biden administration. Debt ceiling issues. Escalating geopolitical effervescence vs. Russia and China.

US Dollar Index relevant levels

Now, the index is losing 0.28% at 96.37 and a break above 97.44 (2022 high Jan.28) would open the door to 97.80 (high Jun.30 2020) and finally 98.00 (round level). On the flip side, the next down barrier emerges at 96.09 (55-day SMA) seconded by 95.41 (low Jan.20) and then 94.62 (2022 low Jan.14).