WTI bulls stay in charge in daily resistance

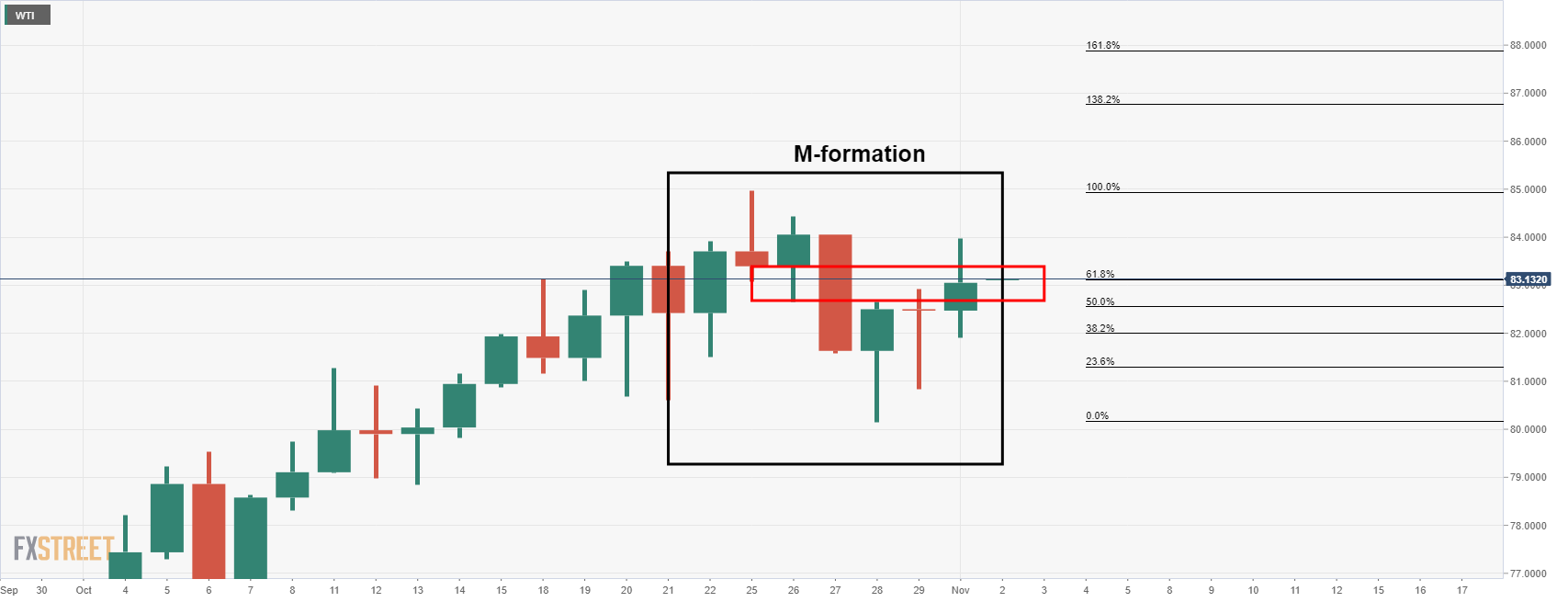

- West Texas Intermediate is taking on the M-formation's neckline.

- Traders expect OPEC+ turn a blind eye to US President Joe Biden's call to add additional supply to the market.

West Texas Intermediate WTI crude oil pierced the daily resistance on Monday following a surge on the back of the market's presumption that OPEC+ will turn a blind eye to US President Joe Biden's request to add additional supply to the market when the group meets later this week. The price travelled from a low of $82.77 to a high of $84.85.

"US President Biden had called upon those countries with spare capacities to step up their oil production to a greater extent. It is doubtful whether OPEC+ will respond to this call, however. Comments made by the two leading countries in the alliance, Saudi Arabia and Russia, indicate that production in December will be increased as planned by 400,000 barrels per day," Commerzbank analysts explained.

This fits with signals from our proprietary gauge of energy supply risk, which has only managed to wobble in response to the Iran wildcard, but which has shrugged off the aggressive decline in European natural gas and Chinese coal prices, analysts at TD Securities explained. ''After all, European natural gas prices are collapsing, but balances are still expected to remain tight this winter in the absence of Nord Stream 2.''

WTI technical analysis

The price is testing the neckline of the M-formation that could still hold and confirming the meanwhile topping formation of the bull cycle.