Back

10 May 2021

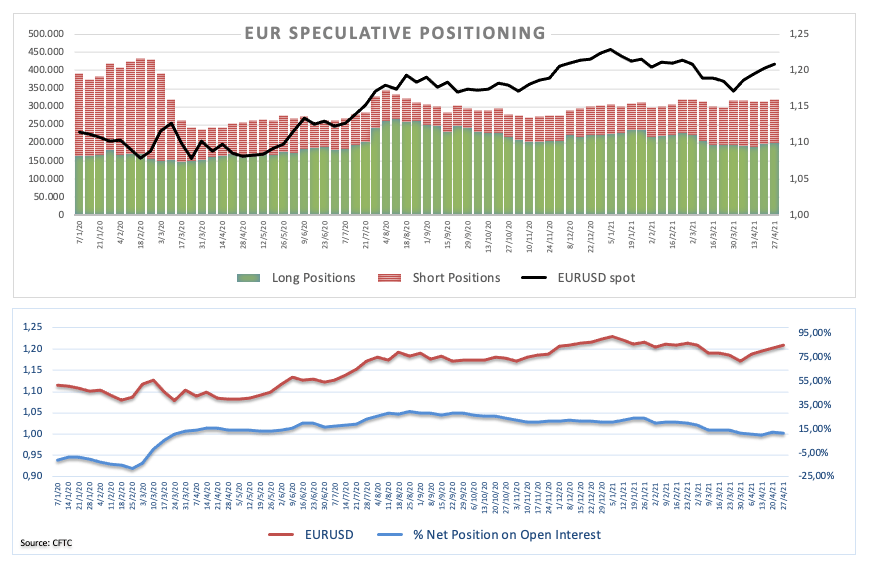

CFTC Positioning Report: EUR net longs in multi-week highs

These are the main highlights of the CFTC Positioning Report for the week ended on May 4th:

- Speculators increased the gross longs in EUR for the third consecutive week, taking net longs to levels last seen in late March. The better pace in the vaccine rollout in the Old Continent coupled with the recovery in German yields lent extra oxygen to the single currency and helped EUR/USD to keep the recovery well in place.

- Speculative net longs in USD retreated to 2021 lows just above the 2K contracts. The US economic rebound narrative continued to lose momentum in benefit of the growth prospects overseas. In addition, the Fed reinforced its dovish message at its meeting in late April, collaborating further with the deteriorated mood around the buck.

- Political jitters and uncertainty surrounding the UK economic rebound kept weighing on GBP and motivated net longs to drop to levels recorded in early February.

- The pick-up in coronavirus cases in India and Japan appears to have sponsored some fresh inflows into the safe haven JPY, trimming the net short position to multi-week lows.