AD/NZD Price Analysis: Bears take over following Aussie CPI

- AUD/NZD drops in the right trajectory but with no cigar for bears waiting on a 4-hour structure.

- Aussie CPI takes the bulls by surprise and clears out stops.

Casting minds back to the start of the week's analysis, AUD/NZD Price Analysis: Bears waiting in the wings for an opportunity, followed by, AUD/NZD Price Analysis: Bears still holding out for a signal, the market has indeed melted to the downside.

Heading into the Australia Consumer Price Index event, there had not been a much needed 4-hour bearish close below very important support structure and the prior daily close was making for the potential support structure:

AUD/NZD Price Analysis: Bulls holding the fort

While the emphasis was still on the downside, there had to be a convincing break of 4-hour support in order for traders to put money on the table.

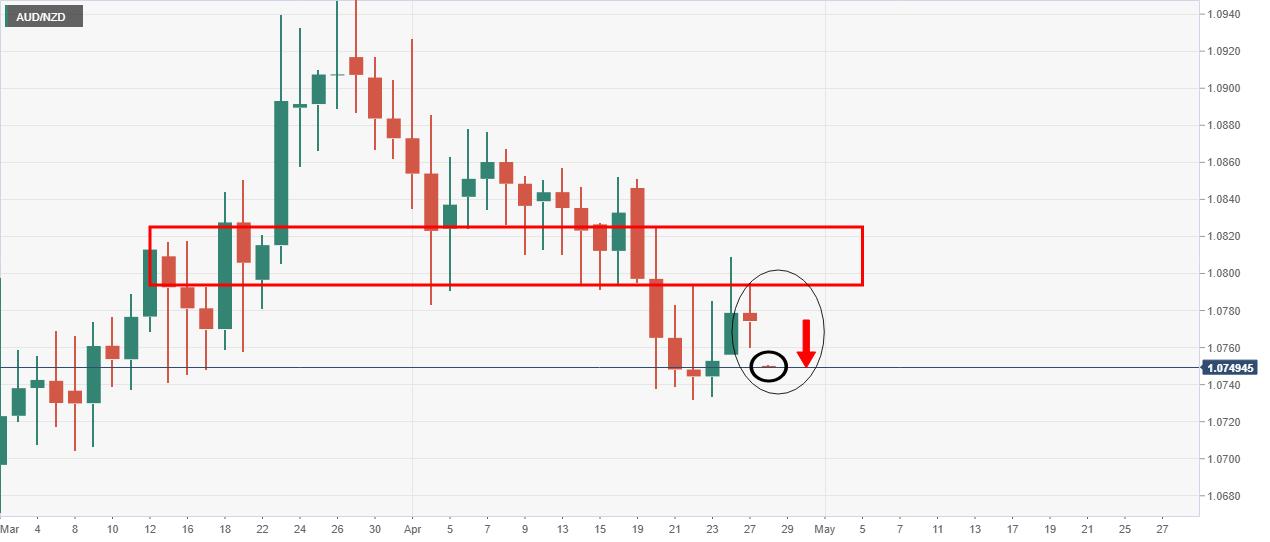

Prior analysis, 4-hour chart

-637551623372743199.png)

As can be seen, the bears have engaged but there have been met with bullish commitments that have equated to a series of downside failures to close below support structure. This is hardly encouraging.

The bulls are taking over at this juncture and now there is a bullish structure on the daily time frame as well.

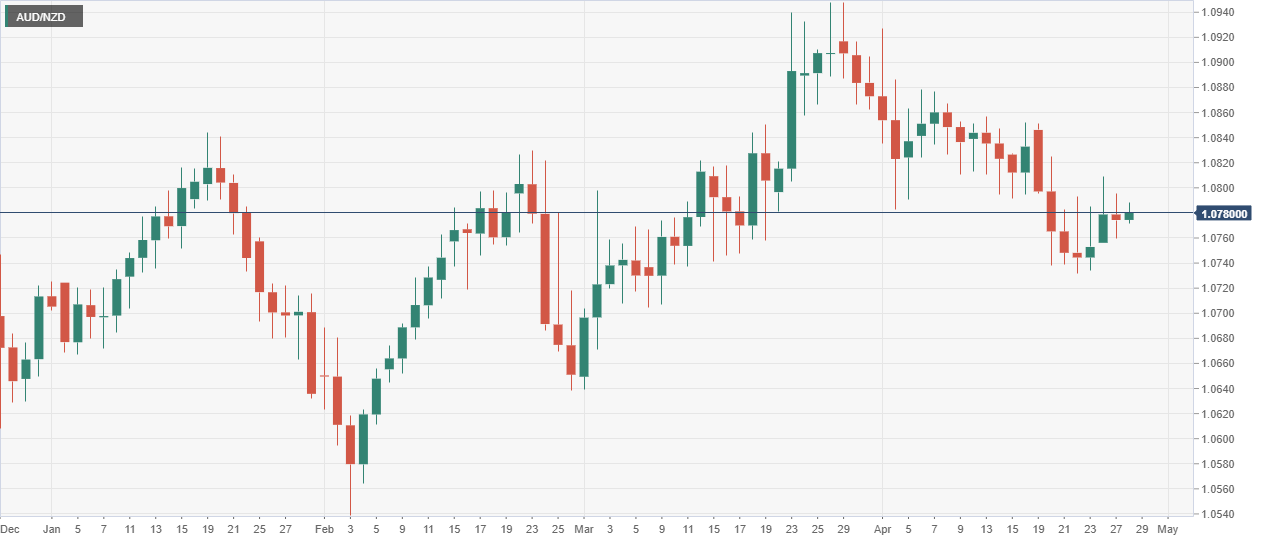

Prior daily chart

As seen, the price has closed on Tuesday with a bearish candle which would now be expected to act as support should Wednesday's candle close higher and bullish.

Meanwhile, the Aussie CPI data has just triggered the move that was expected to the downside without giving the bears the opportunity to engage at 4-hour structure:

Prior analysis, daily chart

-637549879365581432.png)

Live market post CPI bearish spike