NZD/USD Price Analysis: Rebound from intraday low stays doubtful unless crossing 0.7310

- NZD/USD picks up bids following the U-turn from 0.7226.

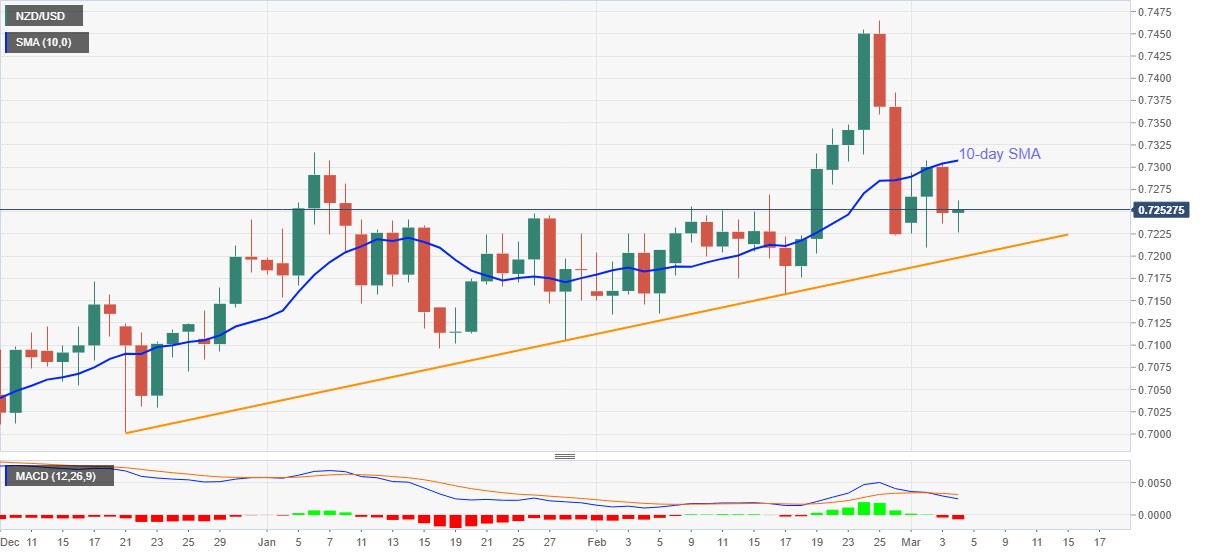

- Sustained trading below 10-day SMA, most bearish MACD signals in a month favor sellers.

- Bulls need to cross January top for upside validation.

NZD/USD wavers around mid-0.7200s, up 0.08% intraday, during early Thursday. In doing so, the kiwi pair keeps the latest bounce off intraday low but struggles to gain further traction to the north.

That said, bearish MACD and the pair’s pullback from 10-day SMA keep NZD/USD sellers hopeful to retest an ascending trend line from December 21, at 0.7198 now.

However, any further downside will trigger a trend channel from the currently favoring bulls to highlight February low near 0.7135 for the NZD/USD bears.

Meanwhile, recovery moves need to cross the 10-day SMA level of 0.7310 on a daily closing basis to convince buyers.

Also acting as an upside barrier is January’s top near 0.7320, a break of which will escalate the run-up to the 0.7400 round-figure ahead of challenging the multi-month top, flashed in February, near 0.7465.

NZD/USD daily chart

Trend: Further weakness expected