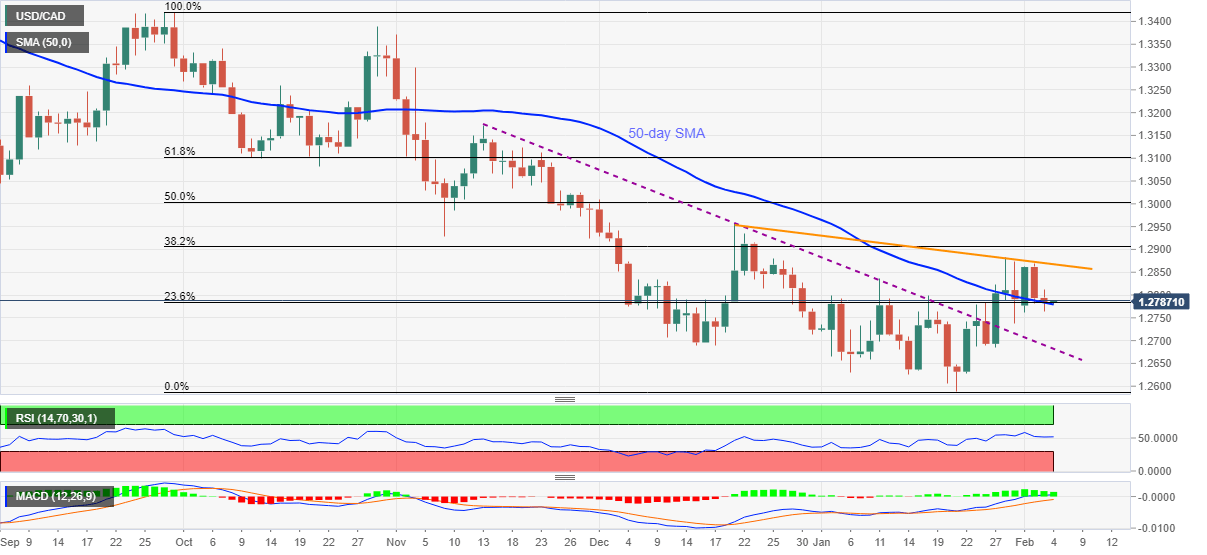

USD/CAD Price Analysis: 50-day SMA, resistance-turned-support keep buyers hopeful below 1.2800

- USD/CAD keeps recovery from 1.2765 amid bullish MACD, upbeat RSI.

- Sustained trading beyond key SMA, support line favor the bulls.

- Six-week-old falling trend line guards upside moves, 1.2630-25 adds to the downside filters.

USD/CAD extends the corrective pullback from the previous day’s low to currently around 1.2785 amid the initial Asian session on Thursday. In doing so, the loonie pair holds the last week’s 50-day SMA breakout amid strong RSI and bullish MACD signals.

As a result, the latest recovery moves are likely targeting the 1.2800 threshold, for now, ahead of challenging a descending trend line resistance line from December 21, currently around 1.2870.

It should, however, be noted that the sustained trading beyond 1.2870 enables the USD/CAD bulls to question the late December tops near 1.2960 while targeting the 1.3000 psychological magnet.

Meanwhile, a downside break of a 50-day SMA level of 1.2780 needs validation from a downward sloping support line stretched from November 13, near 1.2680.

Also challenging the USD/CAD sellers are early January lows near 1.2630-25 and the previous month’s bottom surrounding 1.2590.

Overall, USD/CAD is likely to stay on the buyers’ list until it breaks 1.2625 on a daily closing basis.

USD/CAD daily chart

Trend: Further recovery expected