Back

6 Jan 2021

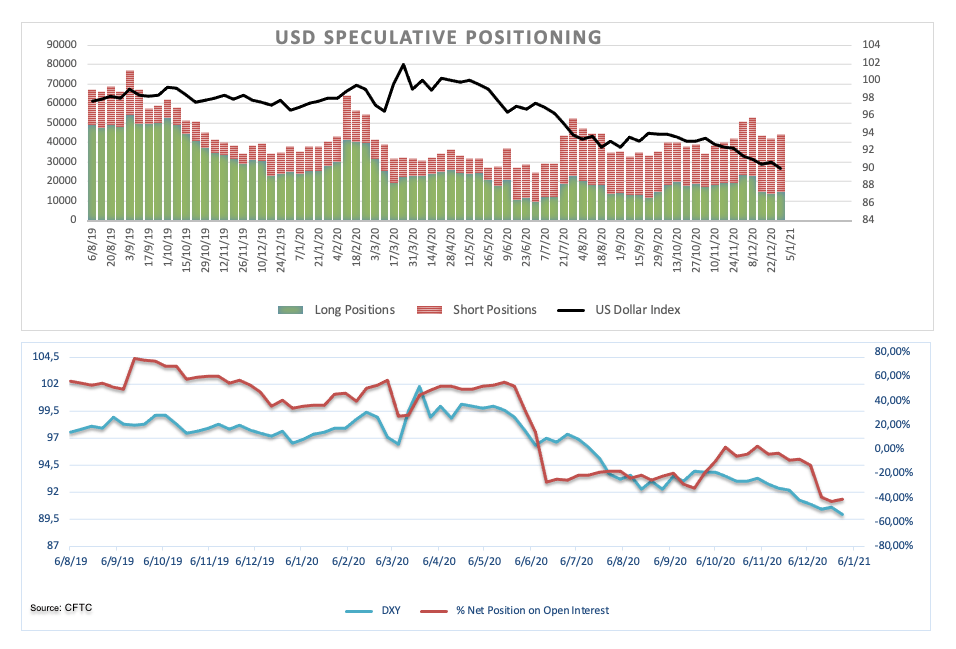

CFTC Positioning Report: USD net shorts receded from extreme levels

These are the main highlights of the CFTC Positioning Report for the week ended on December 29th:

- Net shorts in the dollar dropped marginally to 2-week lows after five consecutive weekly advances. The prospects for the greenback, however, remain well into the bearish territory amidst the ultra-accommodative stance from the Federal Reserve and the dominance of the risk-on sentiment.

- GBP net longs receded to 2-week lows. The quid managed to stay within the positive territory for the fourth consecutive week despite the poor prospects for the UK economy in light of the ongoing coronavirus pandemic. Speculators could well change their view on the pound following the announcement of the third national lockdown earlier this week.

- Speculators marginally trimmed their net longs in EUR, as investors’ appetite for riskier assets, favourable differential in real interest rates (vs. the US) and solid hopes of a strong economic recovery remain supportive of the single currency.