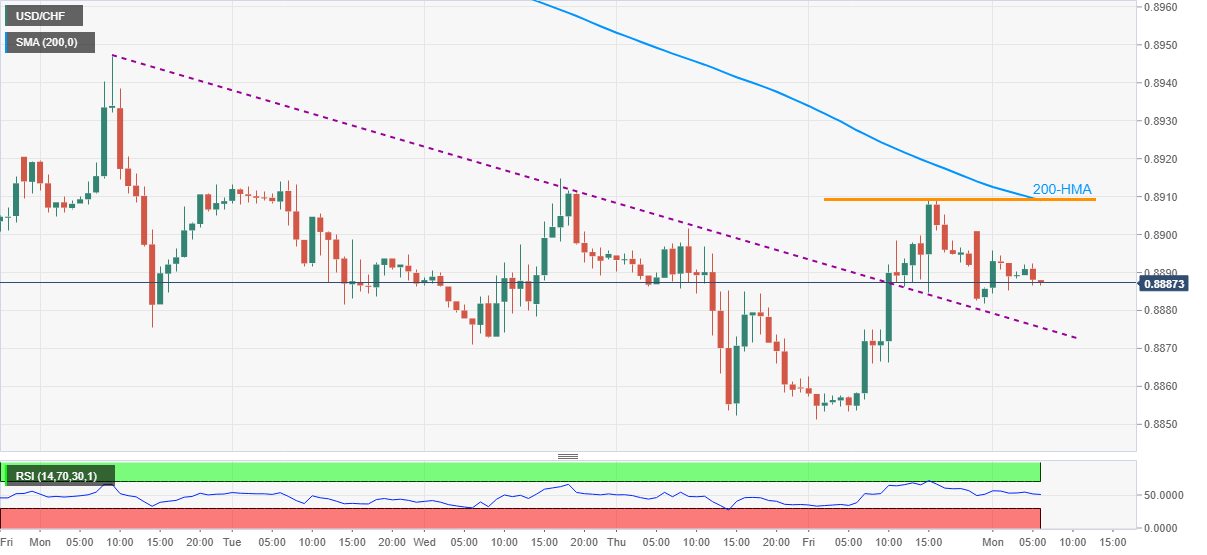

USD/CHF Price Analysis: Bears look to previous resistance line below 0.8900

- USD/CHF fades bounce off intraday low, stays above one-week-old support line.

- 200-HMA, Friday’s high guard immediate upside, bears target mid-0.8800s.

USD/CHF drops to 0.8888, down 0.05% intraday, ahead of Monday’s European session. In doing so, the quote fails to keep the recent recovery moves while keeping the upside break of a falling trend line from December 07.

Even if the normal RSI conditions suggesting further weakness, the previous resistance line, at 0.8876 now, will probe the bears targeting the monthly low near 0.8850.

It should, however, be noted that a clear downside break of 0.8850 will not refrain from probing the 0.8800 round-figure. Though, 0.8815/10 region comprising highs marked during early January 2015 can offer breathing space to the USD/CHF sellers.

Meanwhile, a confluence of 200-HMA and Friday’s high, around 0.8910, will guard the pair’s short-term upside.

In a case where the quote stays past-0.8910, it needs to cross November’s low around 0.8980 to recall the USD/CHF buyers.

USD/CHF hourly chart

Trend: Bearish