Back

8 Dec 2020

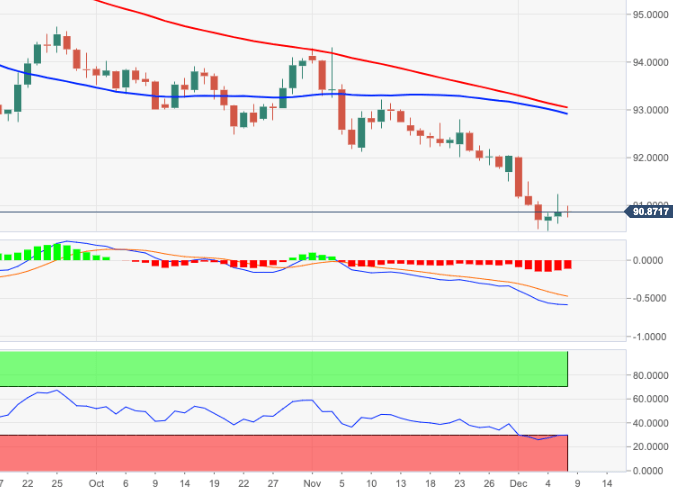

US Dollar Index Price Analysis: A drop to 90.00 is not ruled out

- DXY struggles to gather serious upside traction.

- Extra gains should face initial resistance near 91.50.

The index fails to sustain a serious bullish attempt, as the broad stance on the dollar remains tilted to the bearish side.

That said, bouts of buying pressure are expected to meet interim hurdle in the vicinity of 91.50, where sits the 9-month (resistance) line ahead of the Fibo level at 91.92. Above this region, the downside pressure is predicted to mitigate somewhat.

In the meantime, as long as DXY trades below the 200-day SMA, today at 95.77, the negative view is forecast to prevail.

DXY daily chart