GBP/CAD Price Analysis: Possible day trade opportunity on the horizon

- GBP/CAD has come up for air during the Asian session, with a move sparked by additional Brexit headlines.

- The price of oil is also coming off which adds fuel to the fire for CAD bears.

The following is a top-down analysis starting with the daily chart, moving in on the 4-hour and the 1-hour to identify where the opportunity might come about.

“It is better to be prepared for an opportunity and not have one than to have an opportunity and not be prepared,”

– Whitney M. Young Jr.

Daily bias to the downside

-637369402853365101.png)

The overall trajectory is to the downside while below the marked resistance structure.

However, there could be some gas left in the bulls yet and the wick on the daily chart is significant, as explained on the 4-hour time frame just below.

4-hour prospects

-637369403074313159.png)

The daily wick is essentially a 4-hour correction to support.

This gives rise to an opportunity to fill-in the wick and would give the resistance a more meaningful test.

1-hour outlook

-637369414459567903.png)

The 1-hour chart offers the possibility of a break of the near term structure.

On a retest of the structure, bulls can look to buy into what could be the next impulse to the 1.73 area.

The set-up would be best suited on a 15-min time-frame with a buy limit at support accompanied by a stop loss below the 15-min support structure to protect against a failed trade setup.

The setup will likely offer something in the region for 1 to 2 risk to reward ratio.

Breakeven would be the first course of action as soon as the price makes new support structure above the entry point where the stop loss will be moved to, factoring in the spread and or commissions.

Correlations reinforcing the bullish outlook

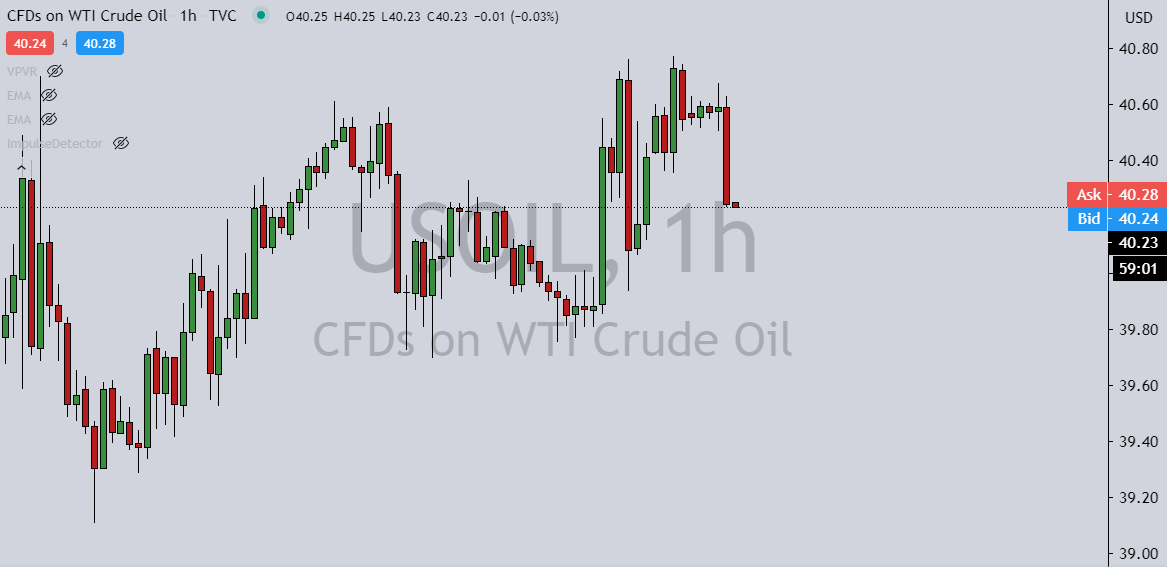

Backing the bullish prospects are the following Brexit news and offers in oil, now down -67% on the day so far in WTI:

- WTI Price Analysis: Bears lining-up for the 'Kill Zone'