When are the UK retail sales and how could they affect GBP/USD?

UK Retail Sales Overview

The UK Retail Sales, scheduled to be published at 06:00 GMT on Friday, is expected to ease from 13.9% prior advance to 2% MoM in July. Total retail sales are seen stabilizing around 0.0% over the year in the reported month, though up from -1.6% booked previously.

Meanwhile, core retail sales, stripping the basket off motor fuel sales, are also likely to trim the latest jump with 0.2% MoM and 1.5% YoY numbers compared to 13.5% and 1.7% respective priors.

Deviation impact on GBP/USD

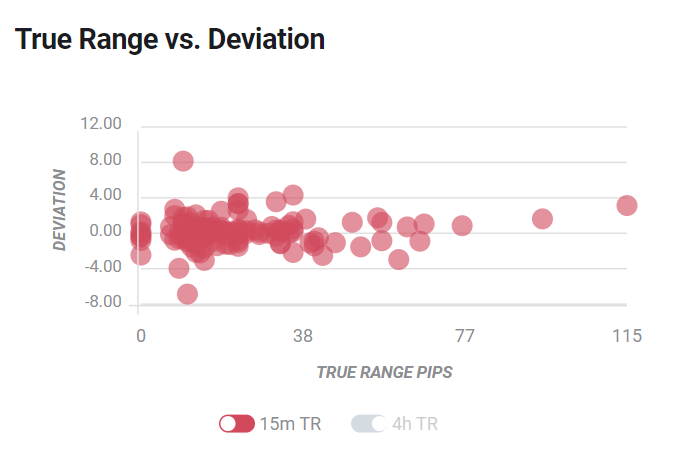

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 80 pips in deviations up to 3.5 to -1.5, although in some cases, if notable enough, can fuel movements of up to 150 pips.

How could it affect GBP/USD?

GBP/USD bulls ride on the broad US dollar weakness despite Brexit and COVID-19 woes at home. As a result, today’s UK Retail Sales may add value to the pair’s upside in case the outcome is stronger than anticipated. However, any extreme weakness in the headline data can’t be neglected as the latest numbers from Britain have been positive and favor the Bank of England (BOE) to keep refraining from negative rates.

TD Securities anticipate a mild recovery in the UK Retail Sales figures as they say,

We look for July's retail sales to increase by 1.5% m/m (market expectations: 2.0%). With retail sales now essentially recovered to their early-2020 levels, the big gains seen in recent months are far less likely. If anything, the risks are that pent-up demand artificially boosted May and June sales, and retail sales trail off from here, ending the year lower than at the start.

On the contrary, FXStreet’s Yohay Elam relies on the official retail sales figures for June and also independent measures from Barclaycard and the British Retail Consortium for July to tease hopes of a strong number.

Technically, GBP/USD stays well bid near the intraday high of 1.3235 while heading into the London open on Friday. The Cable dropped to one-week low amid the initial downside on Thursday before bouncing off 21-day SMA. Given the pair’s refrain from respecting the bears below 21-day SMA, coupled with nearness to the monthly and yearly top, buyers remain hopeful to cross 1.3267 resistance before attacking December 31, 2019 peak surrounding 1.3285. Alternatively, a downside break of 21-day SMA, currently around 1.3070 will have to slip below the 1.3000 threshold and the current month’s low of 1.2981 to target June month’s high of 1.2813.

Key notes

GBP/USD Weekly Forecast: Recovery time? Robust UK retail sales, dovish Fed, may send sterling up

GBP/USD Price Analysis: Eyes the yearly high ahead of UK Retail Sales, PMIs

GBP/USD Forecast: Heading towards its yearly high at 1.3266

About the UK Retail Sales

The retail sales released by the Office for National Statistics (ONS) measures the total receipts of retail stores. Monthly percent changes reflect the rate of changes in such sales. Changes in Retail Sales are widely followed as an indicator of consumer spending. Generally speaking, a high reading is seen as positive, or bullish for the GBP, while a low reading is seen as negative or bearish.