Back

16 Jul 2020

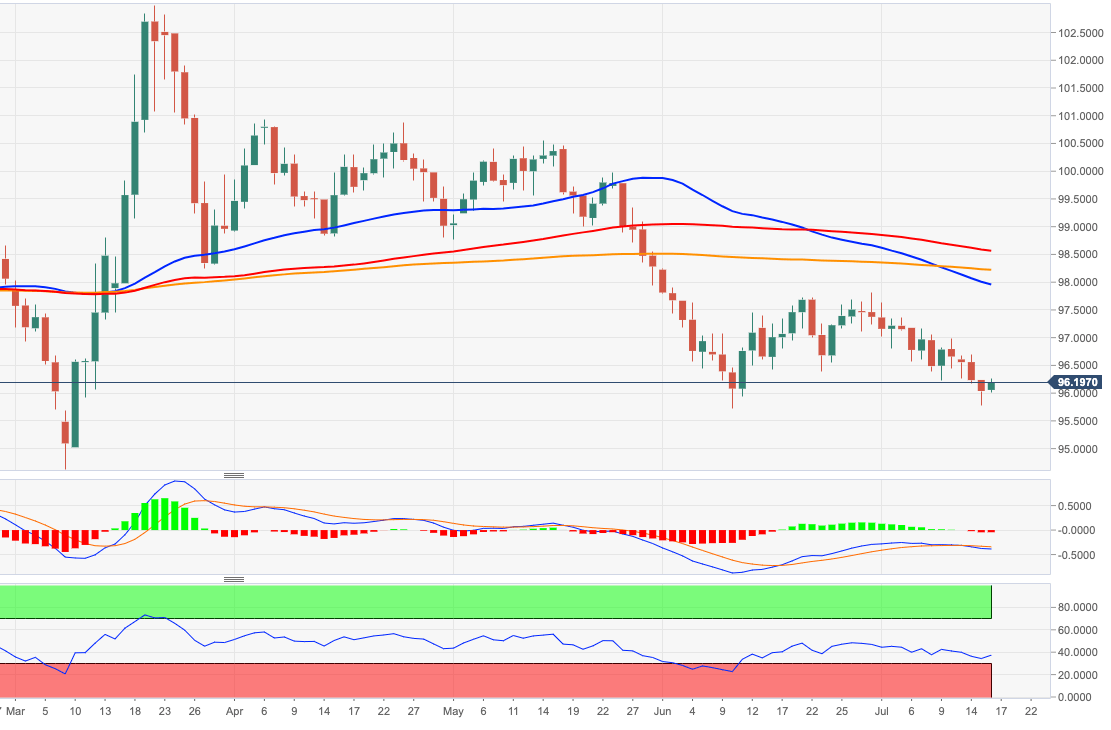

US Dollar Index Price Analysis: Technical rebound faces interim hurdle near 97.00

- DXY reverses the recent drop to the 97.80/75 band.

- The index could rebound further and re-test the 97.00 area.

DXY is seeing some signs of life after it sold off to the 97.80 region on Wednesday, where decent contention appears to have turned out. It is worth mentioning that in the area also converges the June’s low at 95.71. The proximity of the oversold territory is also behind the ongoing rebound.

The continuation of the bounce could see the 97.00 neighbourhood revisited in the near-term. Further up emerges the more relevant hurdle in the 97.90 region, home of mid-June tops, a Fibo level (of the 2017-2018 drop) and the 55-day SMA.

The negative outlook on the dollar is expected to remain unaltered while below the 200-day SMA, today at 98.21.

DXY daily chart