USD/JPY Price Analysis: Off session lows after Xi-Trump call

- USD/JPY attempts recovery from the weekly low.

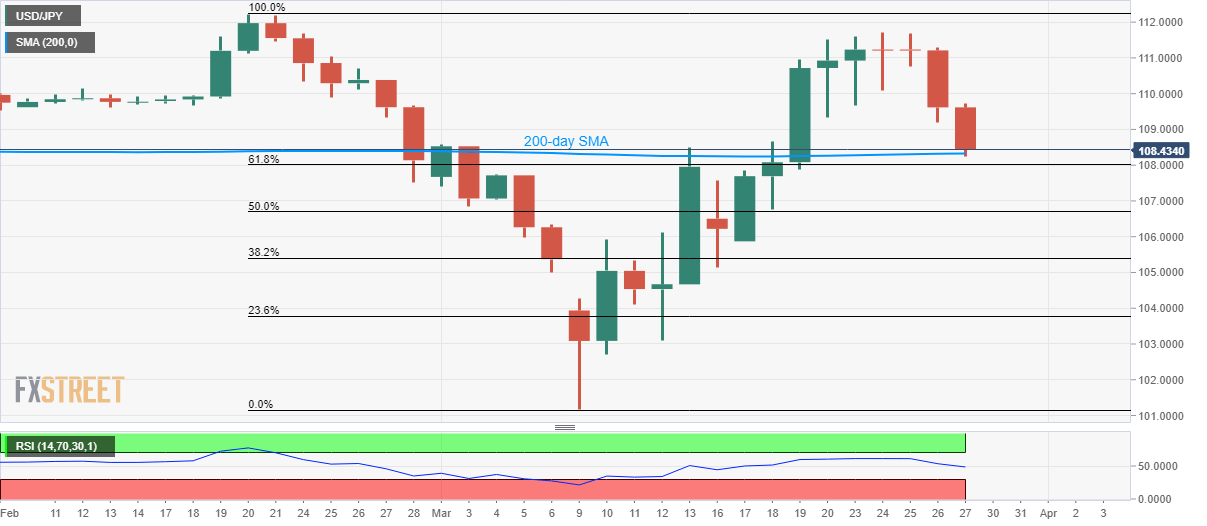

- 200-day SMA, 61.8% Fibonacci retracement limit immediate declines.

- The early-week top holds the key to February high.

With the absence of any rough statement after the calls between US President Donald Trump and his Chinese counterpart Xi Jinping, USD/JPY pulls back from intra-day low to 108.50 during the early Friday.

Not only the cordial tweet from the US leader but the Chinese counterpart's efforts to ease tensions also favored the market to trim earlier losses.

In doing so, the yen pair recovers from 200-day SMA as well as 61.8% Fibonacci retracement level of February-March downside, respectively near 108.30 and 108.00.

While the presence of strong support indicates pair’s bounce, buyers are less likely to be interested in an entry unless breaking the weekly top near 111.70 while aiming the February month high of 112.22.

On the contrary, 50% Fibonacci retracement could please the sellers during further declines below 108.00.

USD/JPY daily chart

Trend: Pullback expected