Back

24 Mar 2020

S&P500 New York Price Forecast: US stocks show signs of life as Fed goes all-in

- S&P500 suffered its largest selloff since 1987 as the coronavirus crisis spooked the market in March 2020.

- S&P500 is bouncing off 37-month lows and challenges 2400 resistance.

- The Fed extended its Quantitative Easing program turning it into the largest stimulus scheme ever created.

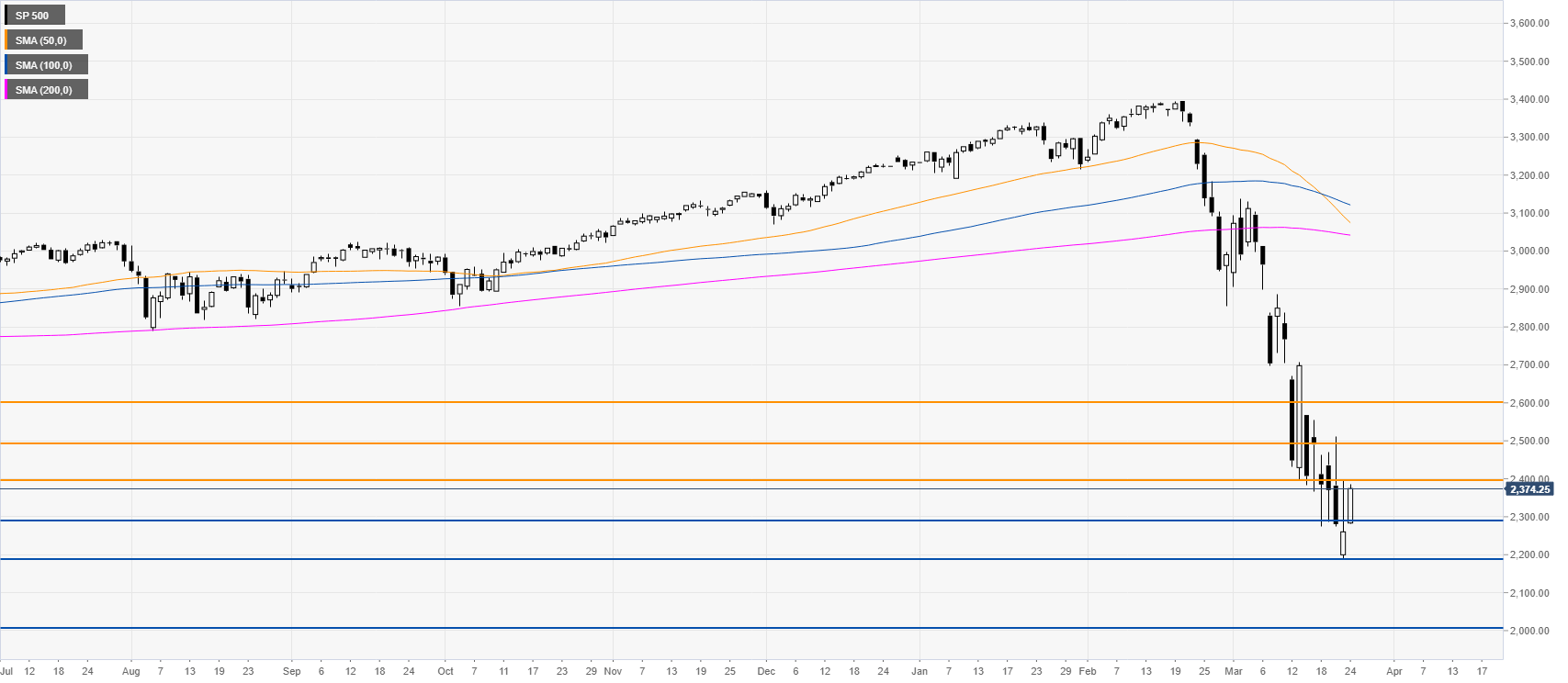

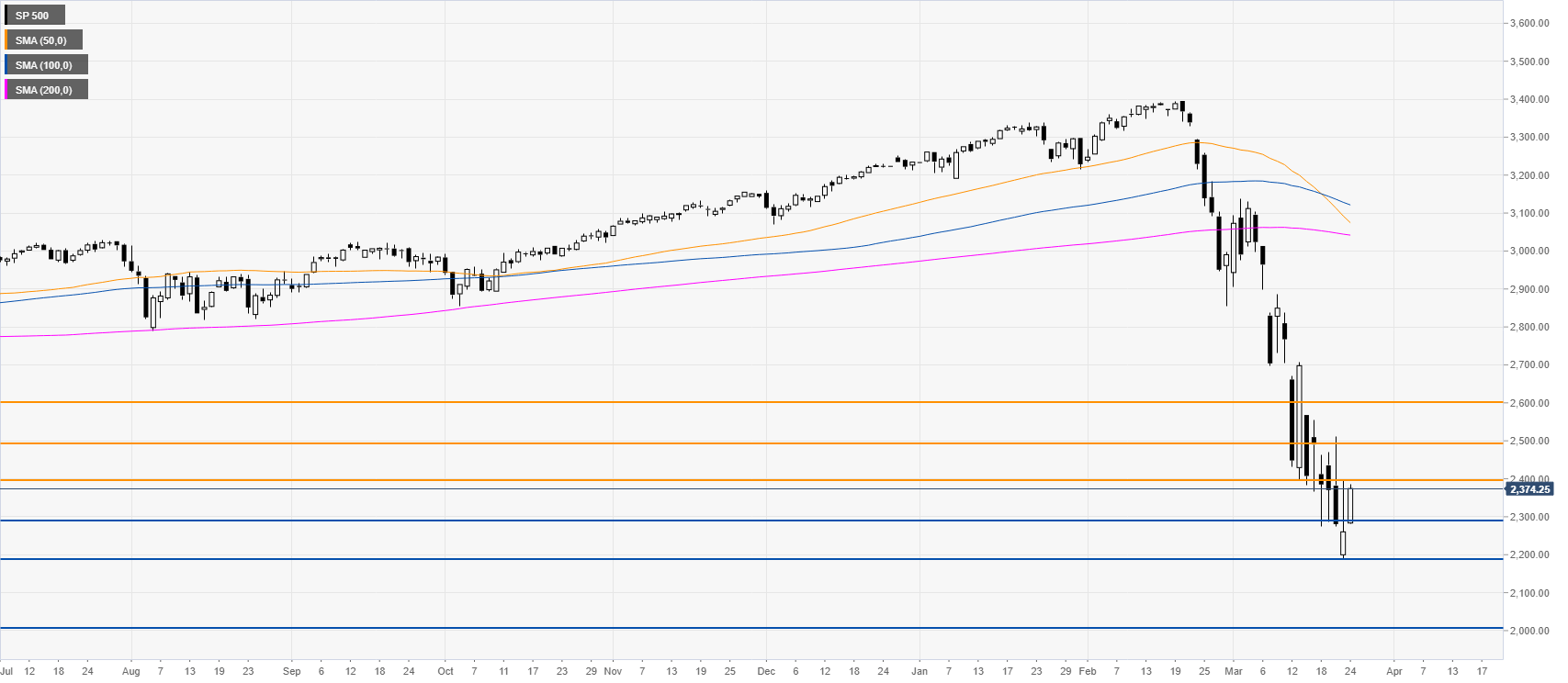

S&P500 daily chart

The market is correcting to the upside after one of the worst selloff in history. The correction could extend to the upside especially on a daily close above the 2400 level while resistance can be seen near the 2500 and 2600 figures on the way up. On the other hand, support is seen near the 2300 and 2200 levels. This Monday, the Fed announced that extended its QE program to basically, ‘infinity’ in order to counter the damage created by the so-called coronavirus crisis. Markets are starting to react slowly but many investors are remaining cautious as uncertainty still prevail in the market.

Additional key levels