Back

6 Nov 2019

EUR/USD technical analysis: Euro vulnerable to further losses, trading below 1.1089 resistance

- EUR/USD remains under bearish pressure in the New York session currently limited by the 1.1089 resistance level.

- The level to beat for sellers is the 1.1072 swing low.

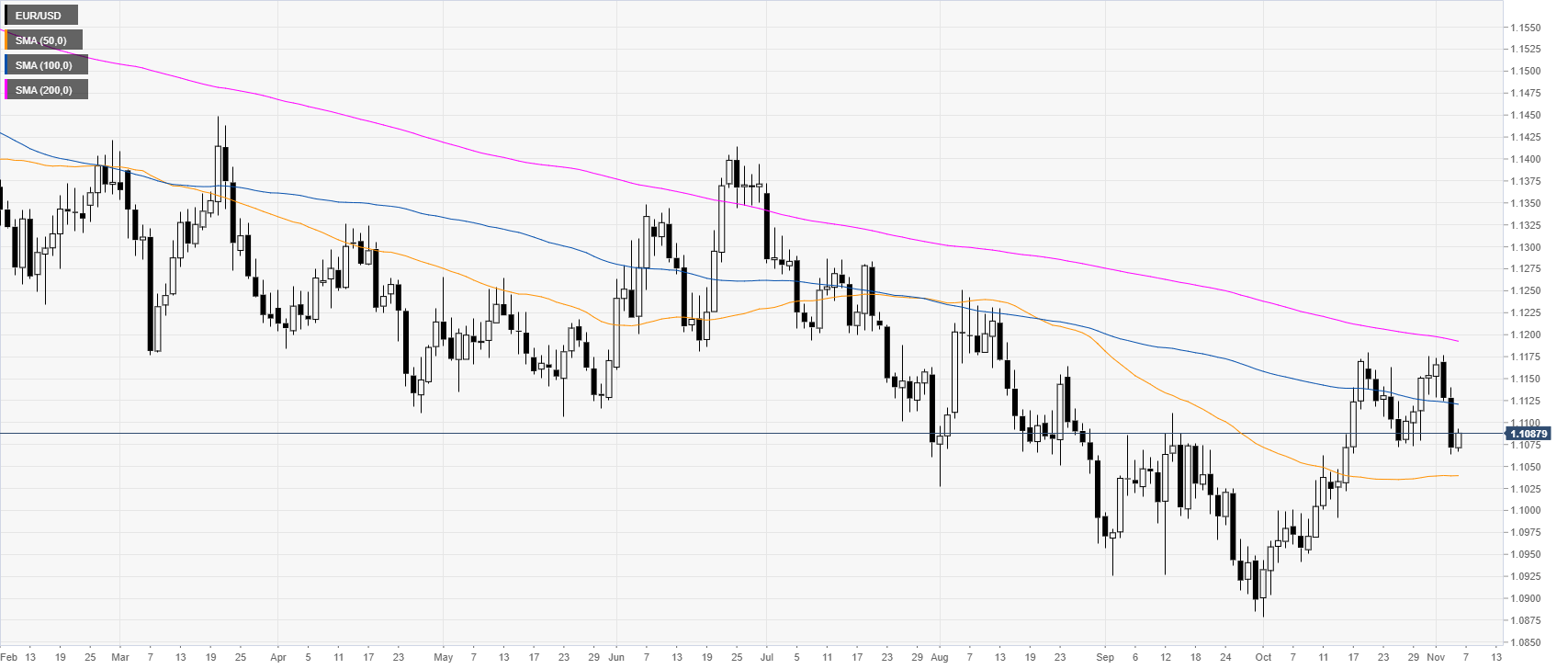

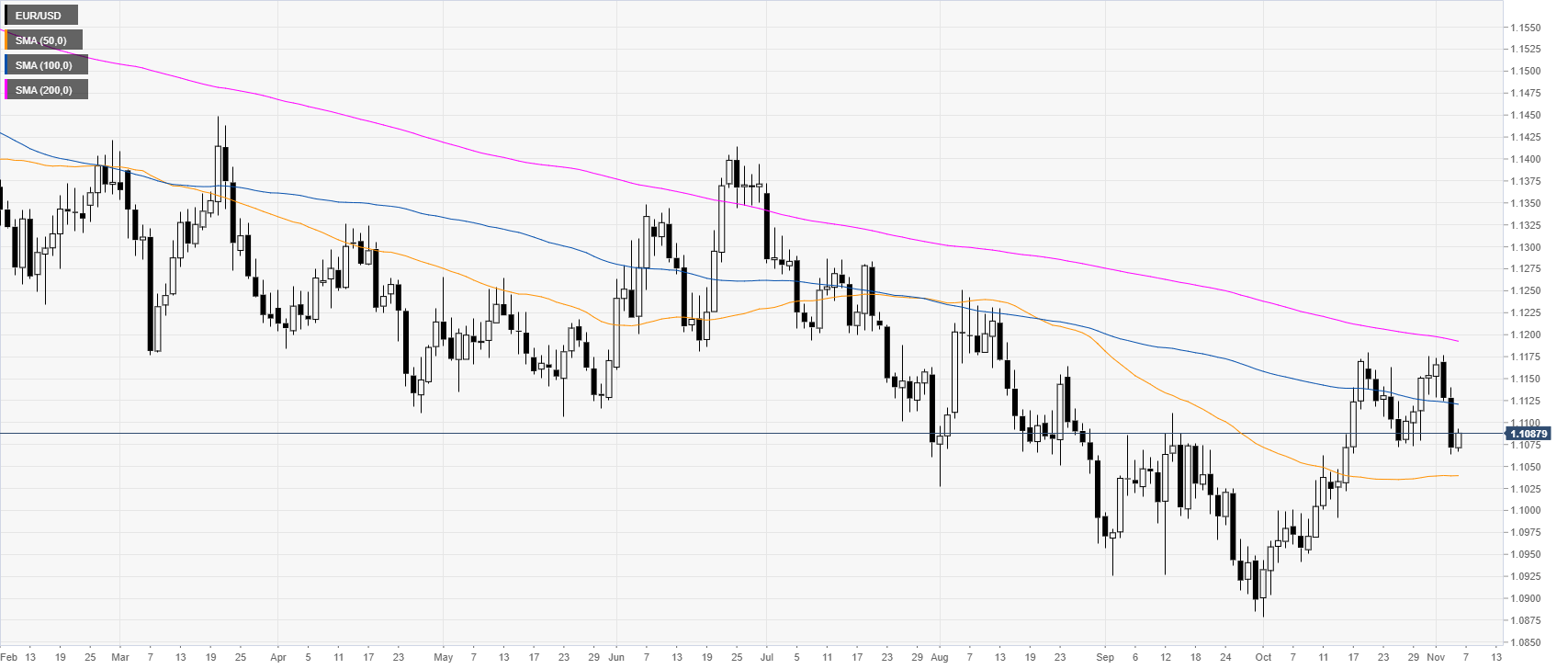

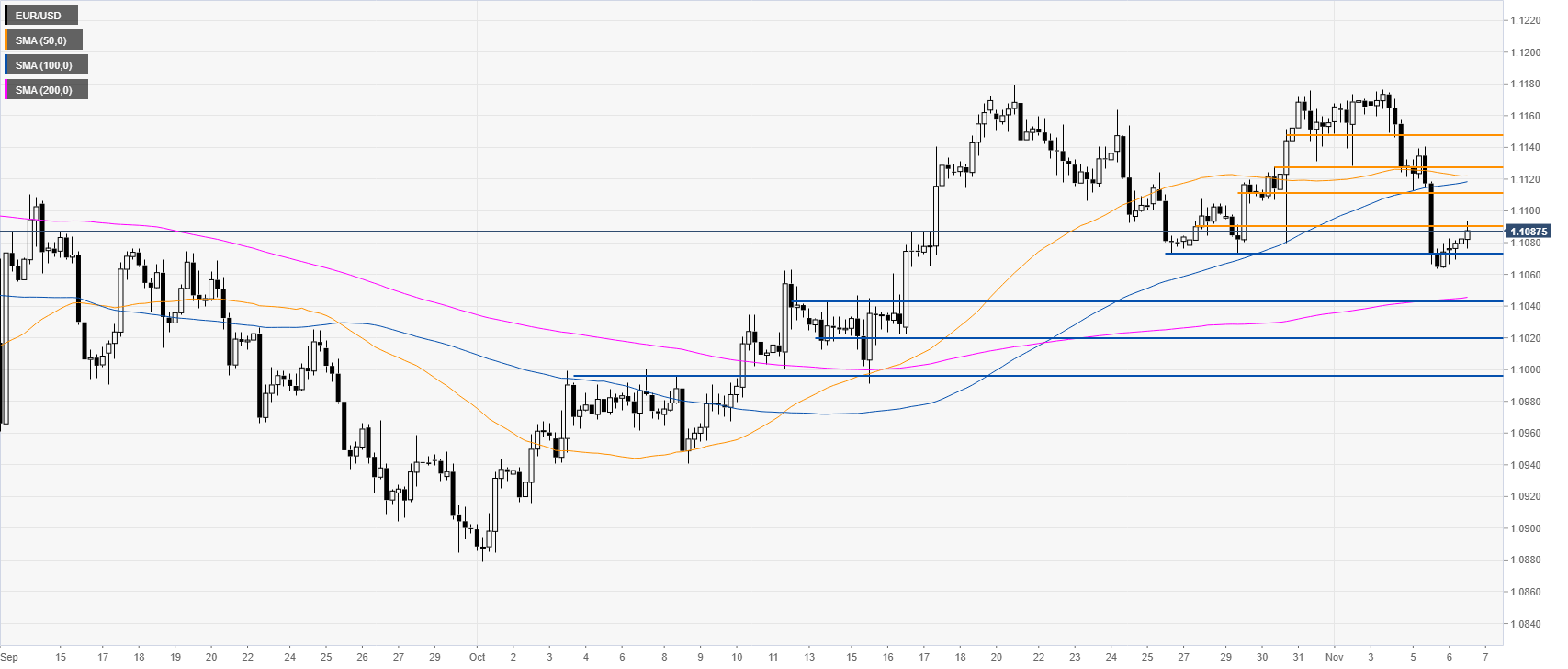

EUR/USD daily chart

On the daily chart, the Euro is trading in a downtrend below its 100 and 200-day simple moving averages (DMAs). The market is consolidating losses above the 1.1072 swing low.

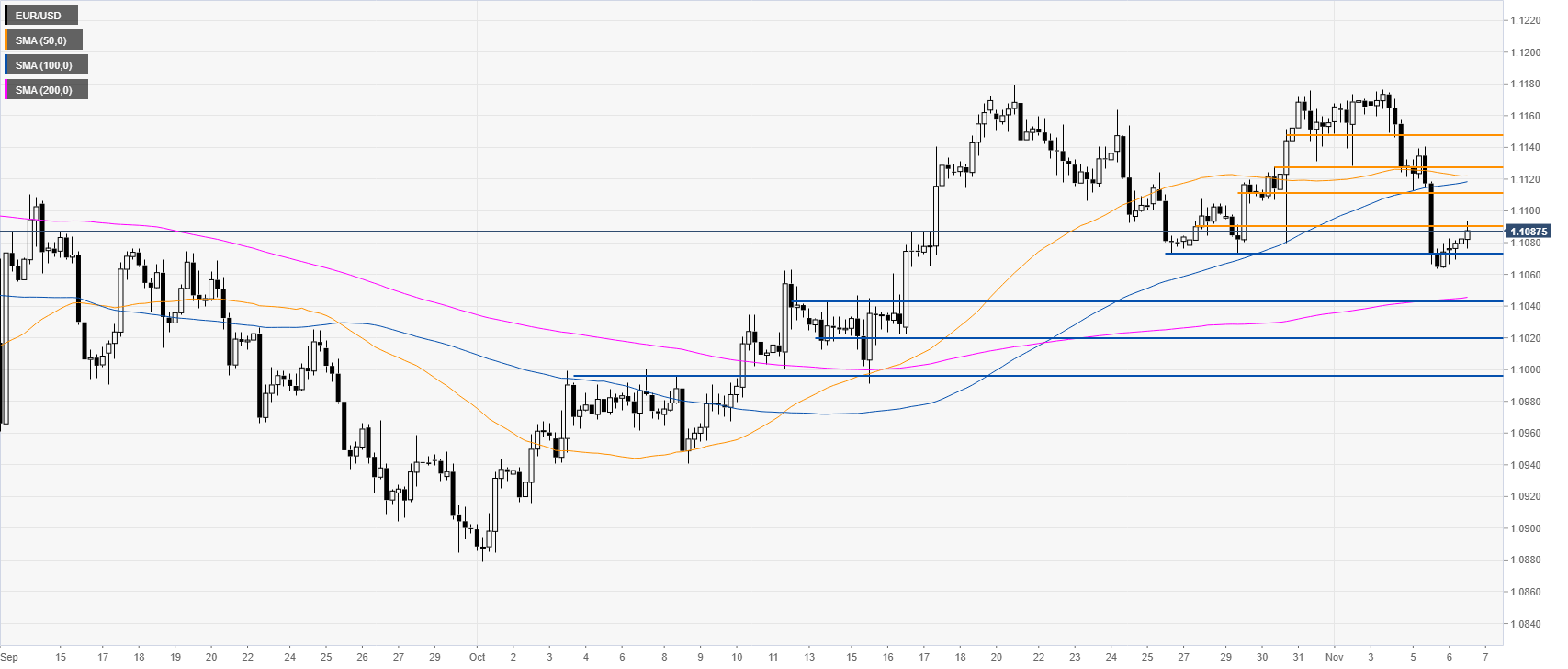

EUR/USD four-hour chart

The Euro is trading below the 50 and 100 SMAs on the four-hour chart. The spot is rebounding mildly from the 1.1072 swing low in what is likely a consolidation. Sellers will be looking for a daily break below the 1.1072 level, which could open the doors to further weakness towards the 1.1043, 1.1020 and 1.0997 price levels, according to the Technical Confluences Indicator.

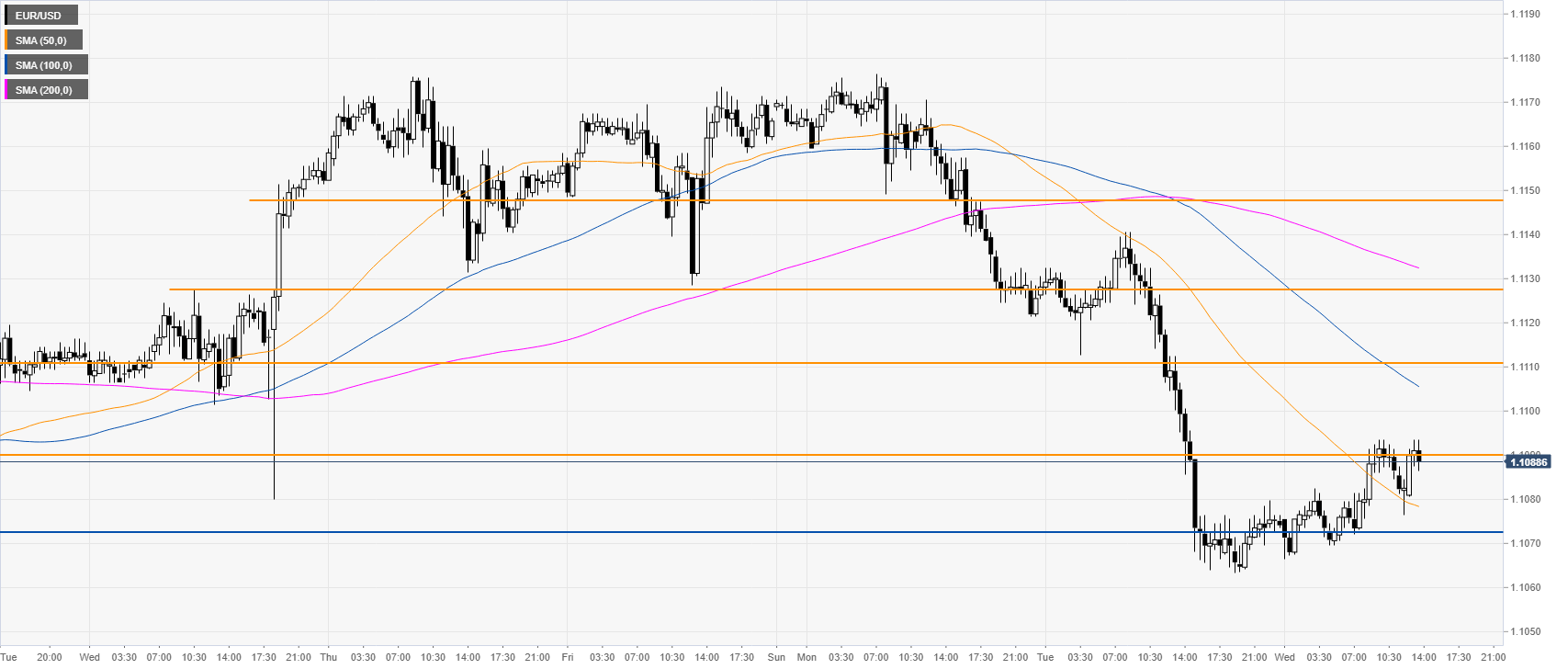

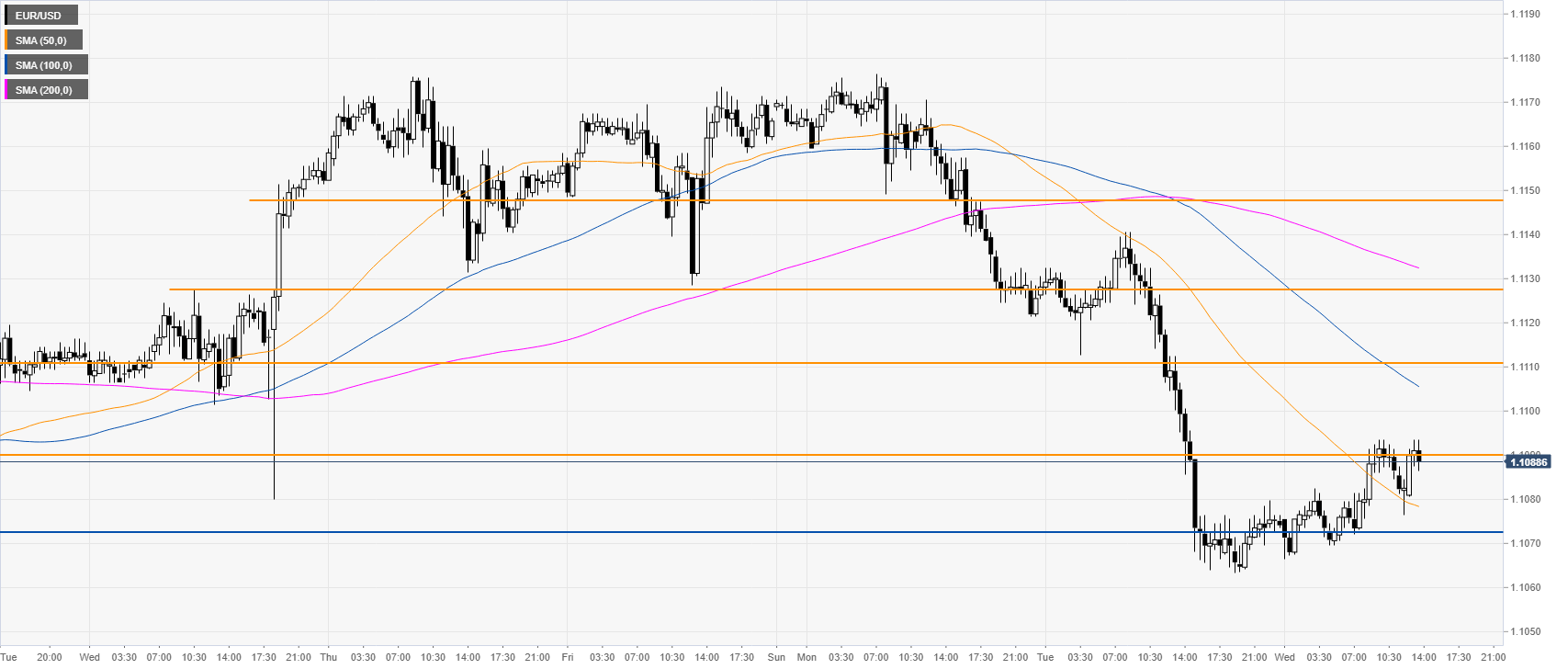

EUR/USD 30-minute chart

EUR/USD is trading at multi-day lows below downward sloping 100 and 200 SMAs, suggesting bearish momentum in the near term. The pullback up is currently limited by the 1.1089 resistances which is not expected to be exceeded this Wednesday.

However, in the event of USD weakness, EUR/USD can spike to the 1.1112 level. Further up lie the 1.1129 and 1.1147 resistance levels, according to the Technical Confluences Indicator.

Additional key levels