EUR/USD drops towards 1.11 - What can we expect this afternoon?

- EUR/USD struggles today and edges toward the 1.11 psychological level.

- USD strength enters the market as US traders get to their desks.

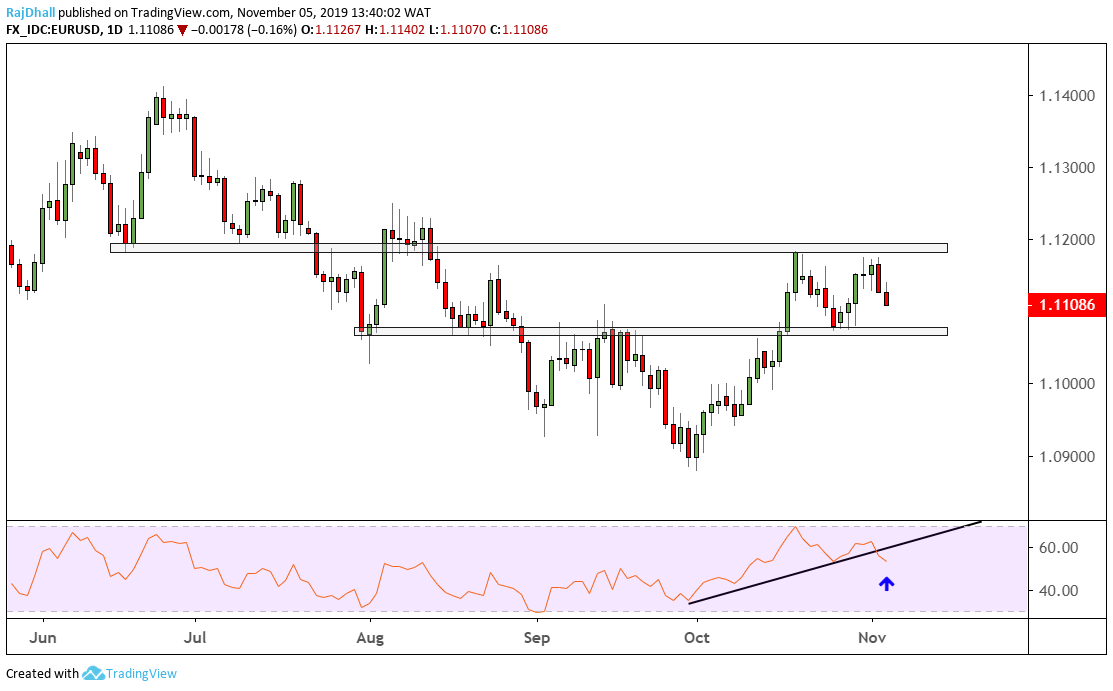

EUR/USD falls after the market struggles to get to 1.12 on the daily chart.

This afternoon we could get some more volatility as the market will receive the latest ISM non-manufacturing PMI reading.

The current risk sentiment in the market is positive as the US-China trade talks seem to be positive.

There were reports yesterday at the US and China could make concessions on tariffs to push the deal through.

Looking at the daily chart below, 1.11 looks like it could be under threat especially if the US data comes in strong this afternoon.

The marked support zone is at 1.1073 and if it breaks it would be a bearish signal as the pair would have made a lower low lower high formation.

Also, the RSI trendline has broken to the downside indicating some more weakness.

Having said all of this the 1 and 3-month option sentiment is still pointing to a bullish EUR as the implied vol skew still currently favours calls.

Obviously this doesn't always work out. Later this afternoon/evening we are expecting to hear from some Fed members and this could give us some insight into what the FOMC is thinking.