Back

15 Oct 2019

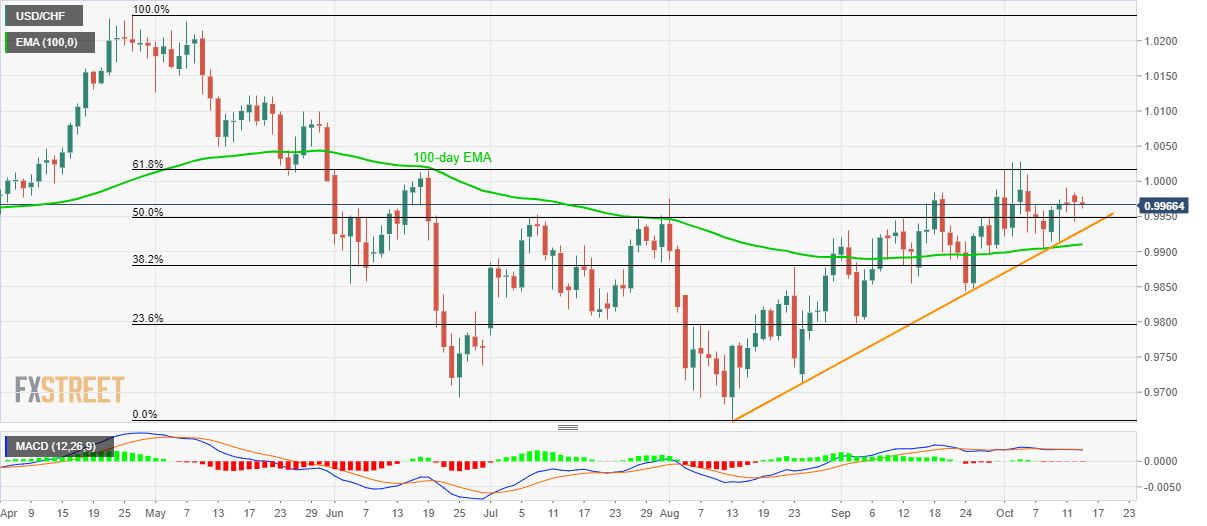

USD/CHF technical analysis: Buyers’ exhaustion around 0.9985/90

- USD/CHF repeatedly fails to cross 0.9985/90 area.

- A two-month-old rising trend-line, 100-day EMA grabs sellers’ attention.

Repeated failures to rise past-0.9985/90 resistance-area drags USD/CHF to 0.9965 by the press time of early Tuesday.

The pair now witnesses pullback towards the two-month-old rising trend-line, at 0.9930, a break of which could further drag the quote to a 100-day Exponential Moving Average (EMA) level of 0.9910.

Though, pair’s declines beneath 0.9910 can take aim at September 24 low nearing 0.9845.

On the flip side, pair’s successful run-up beyond 0.9990 needs validation from 61.8% Fibonacci retracement of April-August declines, at 1.0016, in order to aim for 1.0100 mark.

USD/CHF daily chart

Trend: sideways