Back

8 Oct 2019

US Dollar Index technical analysis: DXY retraces to 99.10 level on Fed’s Powell speech

- The level to beat for bulls is the 99.30/99.40 resistance zone.

- Fed’s Powell speech: Policy is never on a preset course, will change as appropriate.

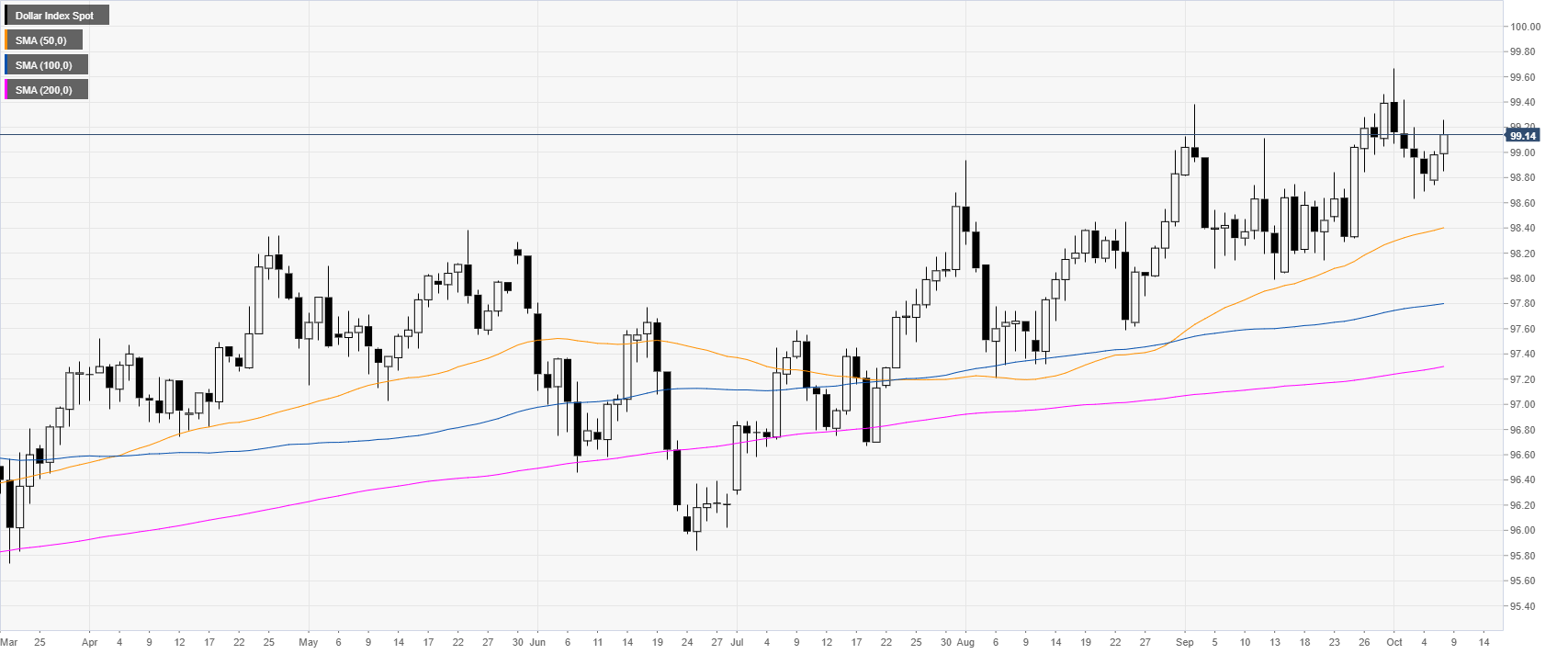

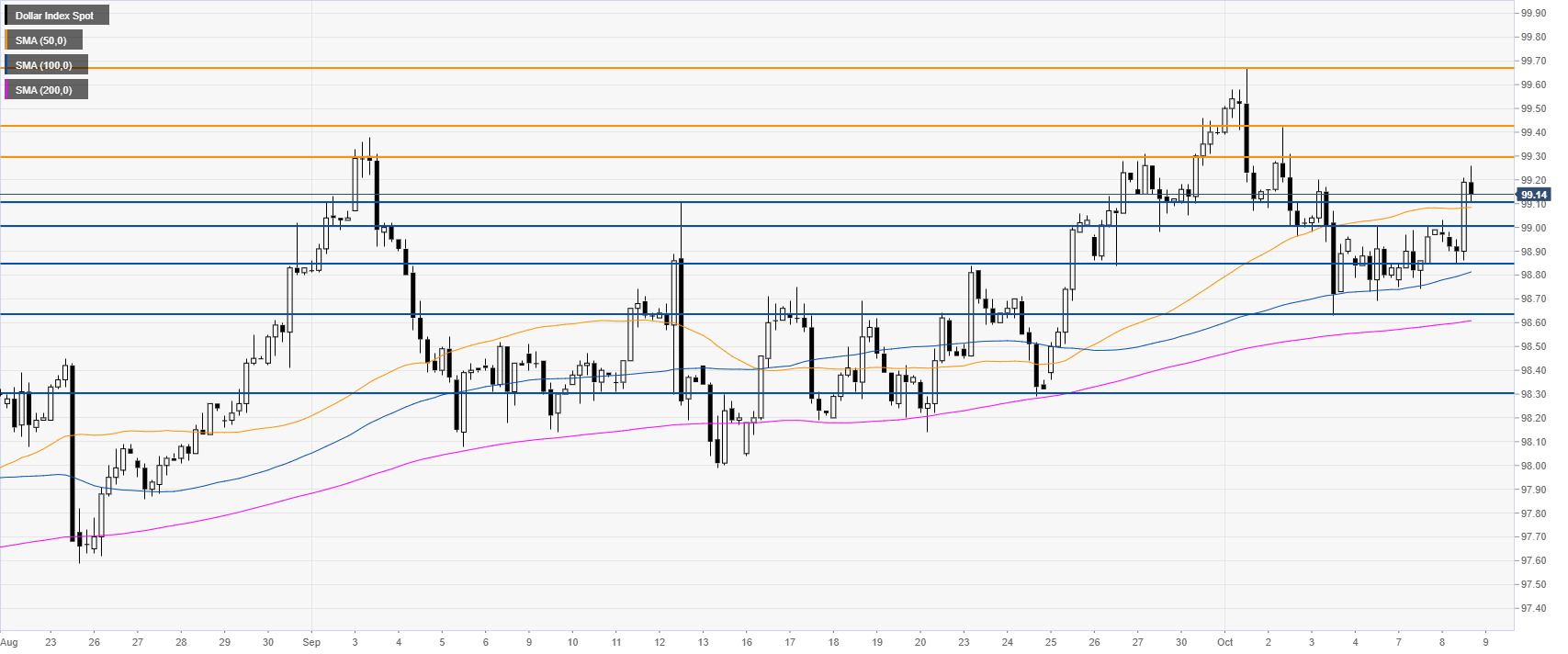

DXY daily chart

The US Dollar Index (DXY) is trading in a bull trend above the main daily simple moving averages (DSMAs). Fed’s Chairman Jerome Powell says that policy is never on a preset course, will change as appropriate.

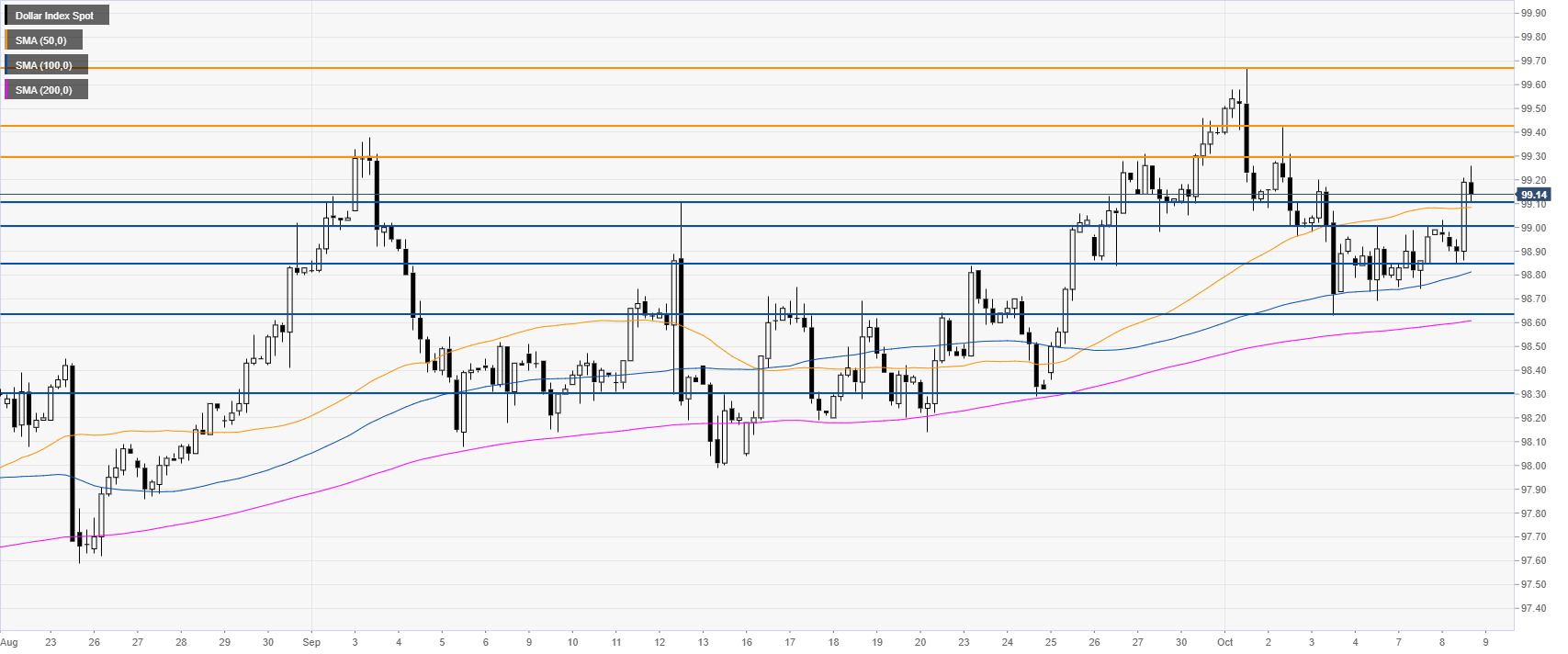

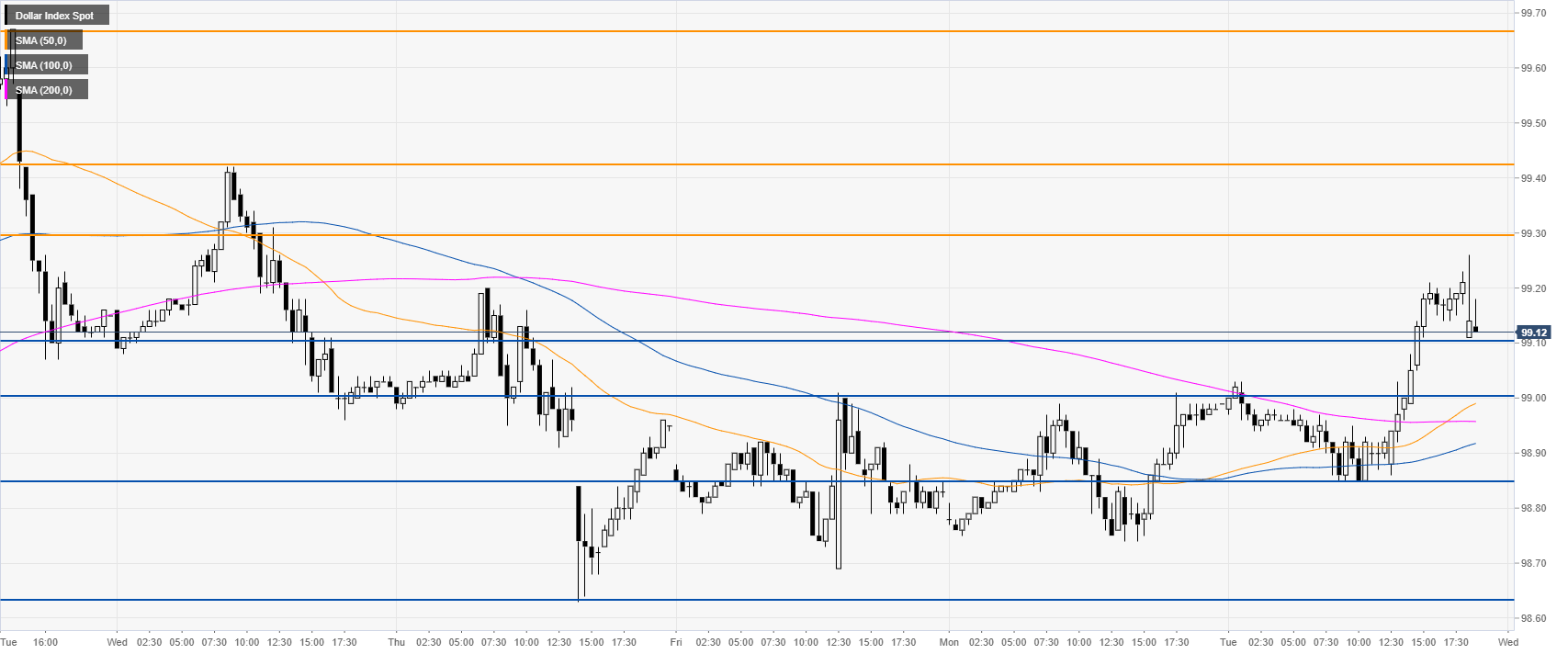

DXY four-hour chart

DXY broke above the 99.10 resistance and the 50 SMA. The Greenback has room to appreciate towards the 99.30/99.43 resistance zone in the medium term.

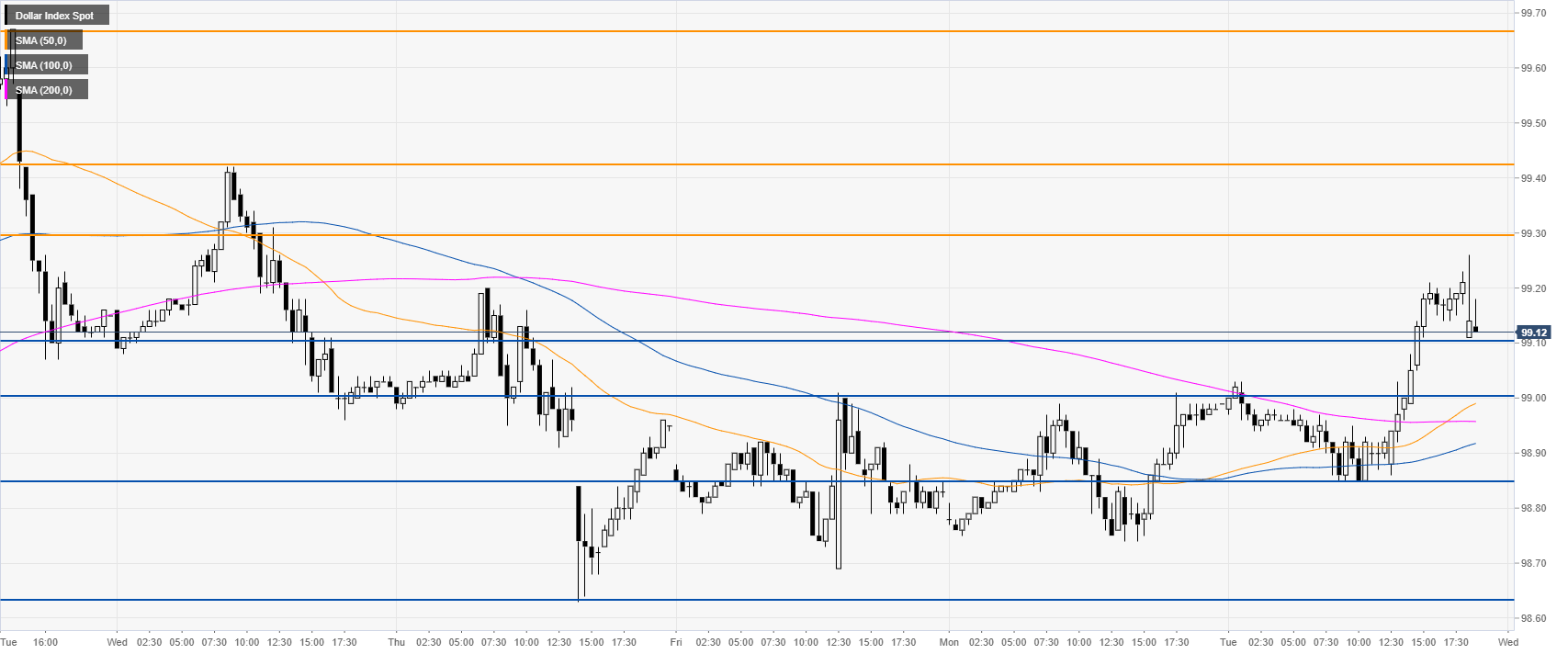

DXY 30-minute chart

DXY is trading above its main SMAs, suggesting bullish momentum in the short term. Support is seen at the 98.10/99.00 support zone.

Additional key levels