USD/IDR technical analysis: Pulls back sharply from session highs, channel breakout elusive

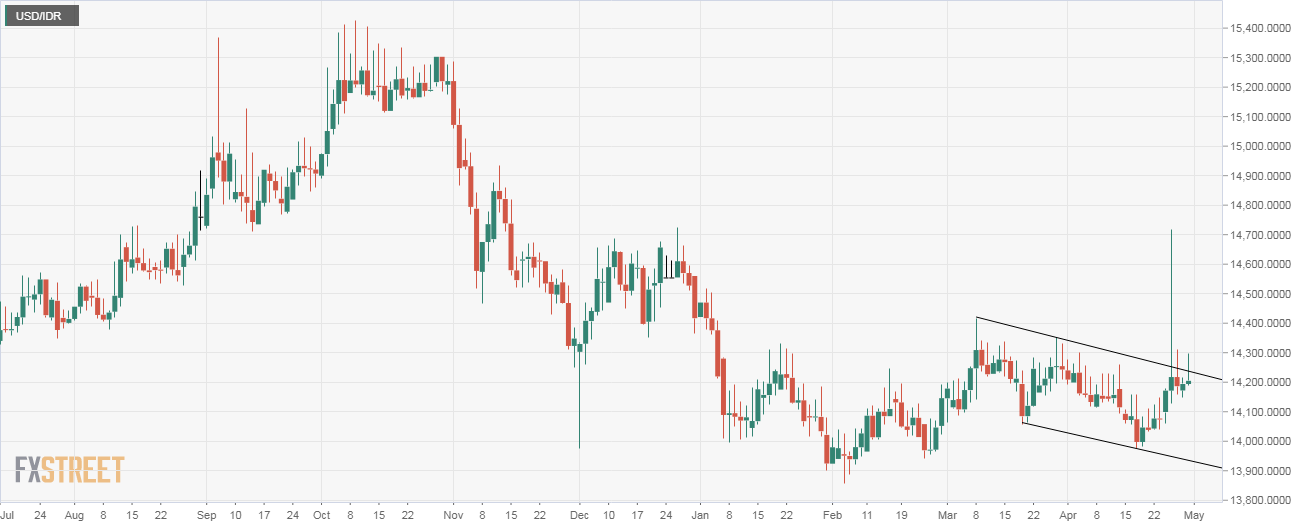

- USD/IDR's struggle for a convincing falling channel breakout continues.

- Back-to-back daily candles with long upper shadows have weakened the bullish case.

USD/IDR has faded the spike to a session high of 14,298 and is currently reporting marginal gains at $14,200.

Essentially, the pair has created a daily candle with a long upper shadow, a sign of bullish exhaustion. More importantly, the daily candle marks failure to hold above the upper edge of the falling channel.

That is the third failure in four days to secure a falling channel breakout, as seen in the chart below.

Daily chart

A repeated failure to chew through offers placed above 14,300 could invite stronger selling pressure, leading to a fall back to 14,000.

A daily close above 14,238 would confirm a channel breakout. However, for the outlook to turn bullish, a sustained move above $14,300 is needed. That could yield a sustained move higher to 14,725 (Dec. 26 high).

Trend: Neutral