US Dollar Index Technical Analysis: DXY jumps above the 96.30 level

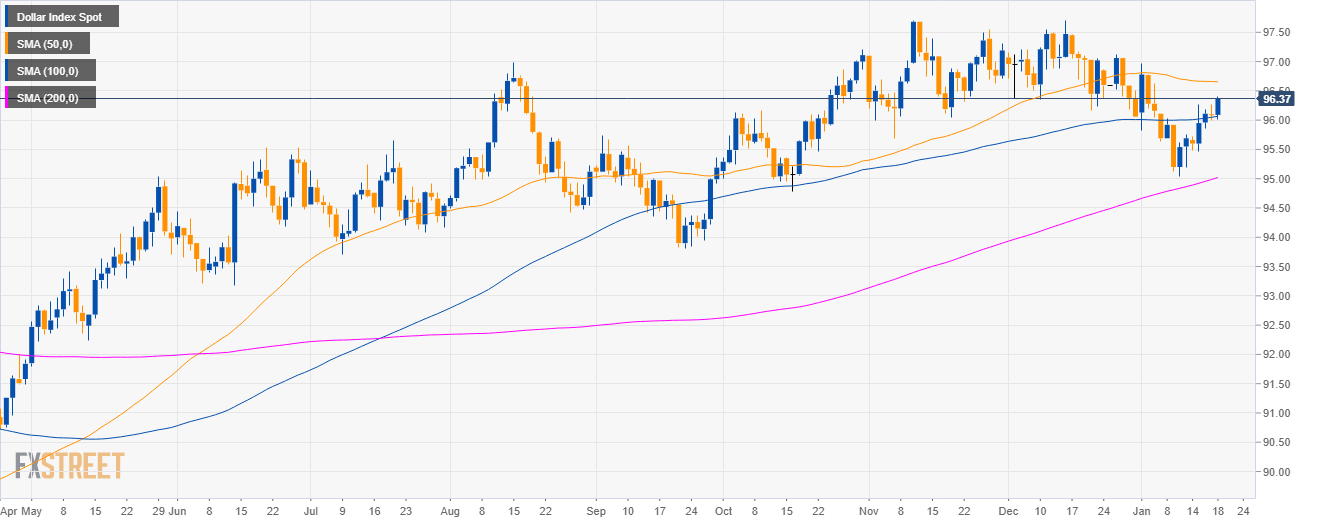

DXY daily chart

- The US Dollar Index (DXY) is trading in a bull trend above the 200-day simple moving average (SMA).

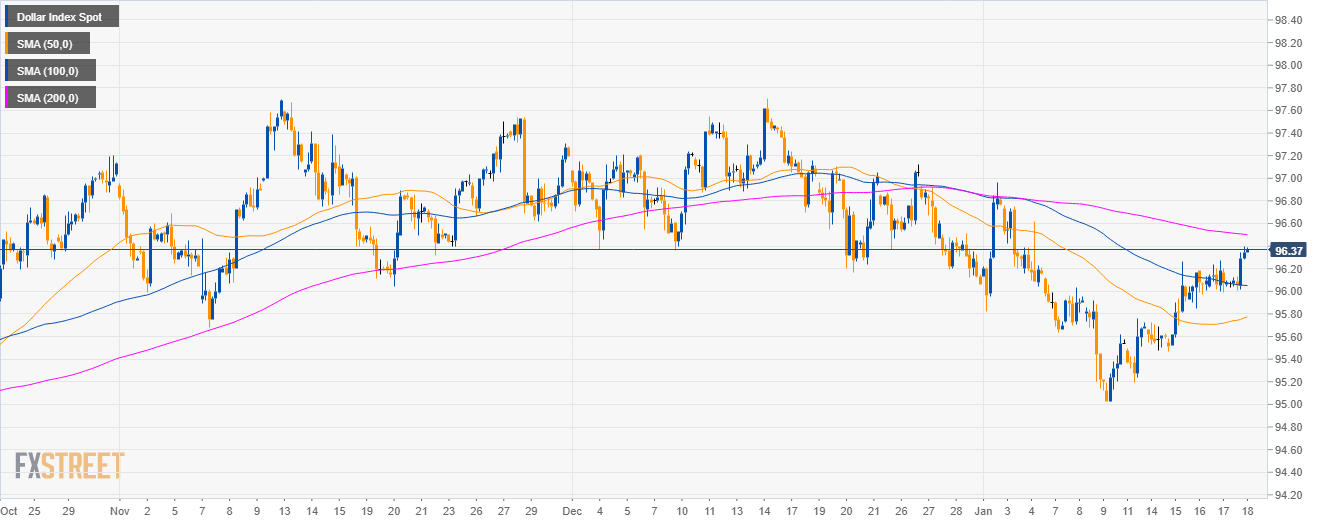

DXY 4-hour chart

- DXY jumped above the 96.30 resistance as the bulls reclaimes the 50 and 100 SMAs.

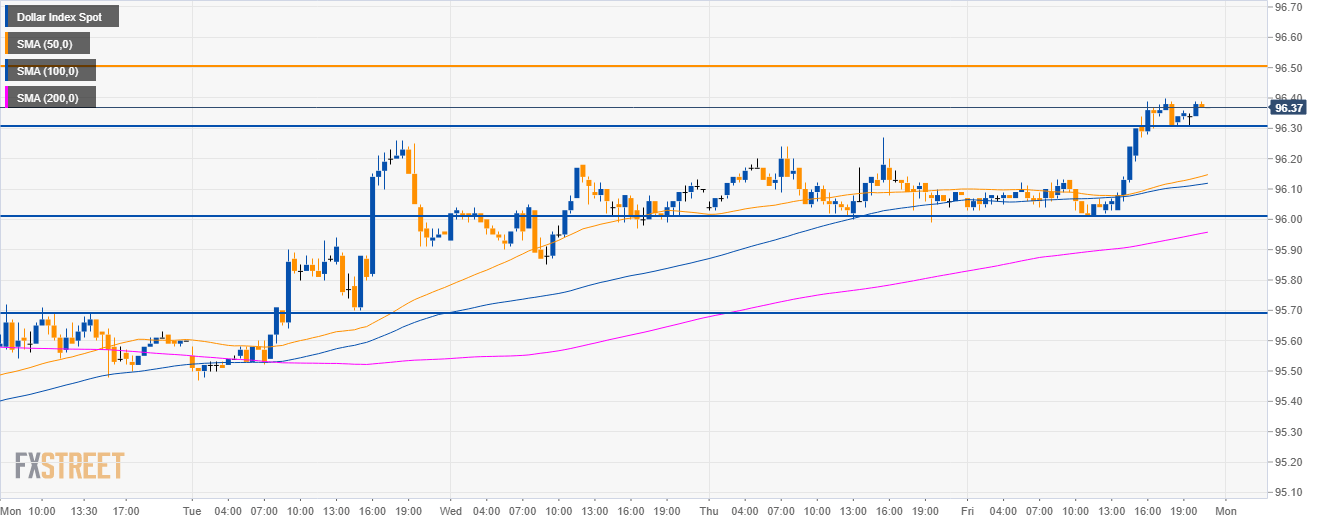

DXY 30-minute chart

- DXY is set to continue its upmove to 96.50 but it remains to be seen how far the bulls can keep the market going.

- To the downside, bears will be looking for 96.30 and 96.00 targets.

Additional key levels

Dollar Index Spot

Overview:

Today Last Price: 96.37

Today Daily change: 0.28 pips

Today Daily change %: 0.29%

Today Daily Open: 96.09

Trends:

Daily SMA20: 96.19

Daily SMA50: 96.66

Daily SMA100: 96.05

Daily SMA200: 94.99

Levels:

Previous Daily High: 96.27

Previous Daily Low: 95.99

Previous Weekly High: 96.12

Previous Weekly Low: 95.03

Previous Monthly High: 97.71

Previous Monthly Low: 96.06

Daily Fibonacci 38.2%: 96.1

Daily Fibonacci 61.8%: 96.16

Daily Pivot Point S1: 95.96

Daily Pivot Point S2: 95.84

Daily Pivot Point S3: 95.68

Daily Pivot Point R1: 96.24

Daily Pivot Point R2: 96.4

Daily Pivot Point R3: 96.52