Back

19 Nov 2018

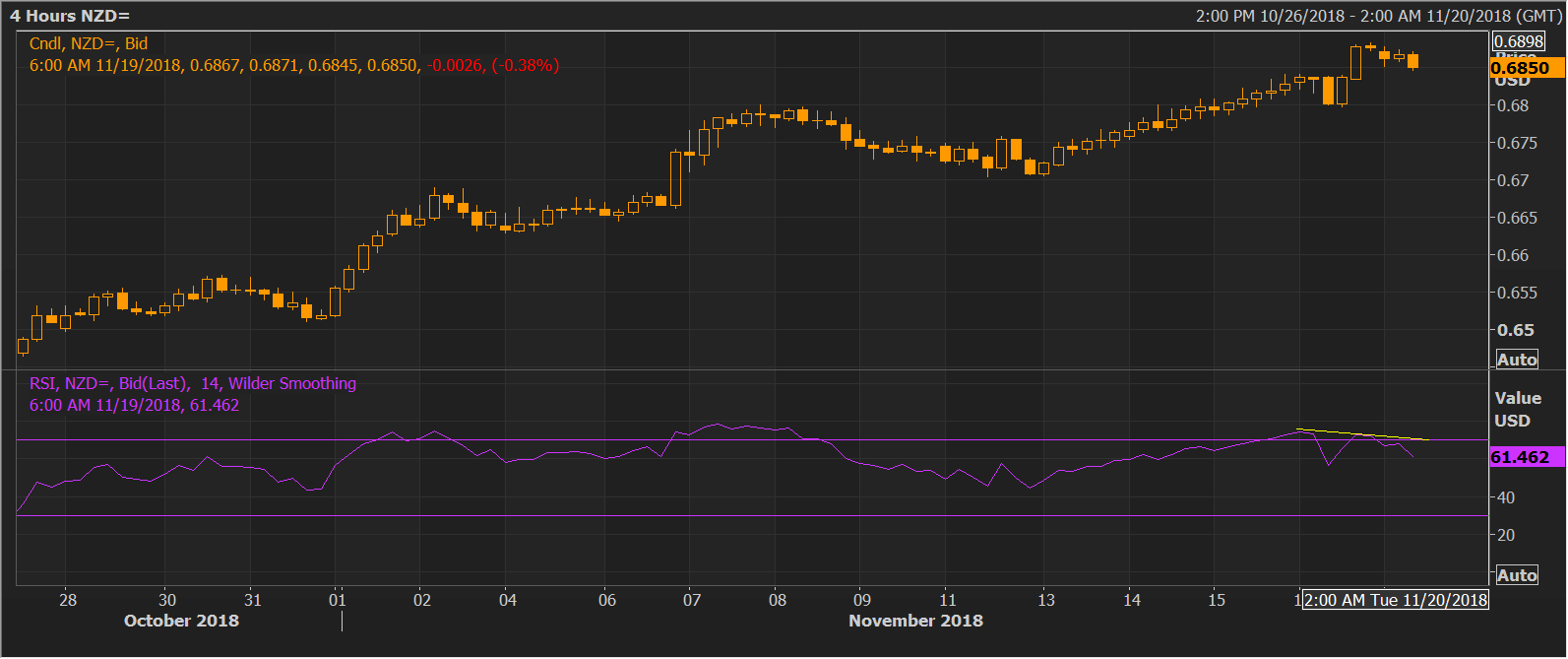

NZD/USD Technical Analysis: bearish RSI divergence seen in 4-hour chart, 5-day SMA support could be tested

- The NZD/USD pair is currently trading at 0.6852, down 0.45 percent from Friday's high of 0.6883, and could witness a deeper pullback to ascending (bullish) 5-day EMA of 0.6822, as the 4-hour chart is showing a bearish divergence of the relative strength index.

- The pullback could be short-lived as the both 5- and 10-day EMAs are trending north, indicating a bullish setup.

- A daily close below the ascending 10-day EMA would invalidate the bullish setup, allowing a short-term consolidation.

4-hour chart

Trend: Pullback likely

NZD/USD

Overview:

Last Price: 0.6854

Daily change: -27 pips

Daily change: -0.392%

Daily Open: 0.6881

Trends:

Daily SMA20: 0.6658

Daily SMA50: 0.6601

Daily SMA100: 0.6657

Daily SMA200: 0.6892

Levels:

Daily High: 0.6884

Daily Low: 0.6798

Weekly High: 0.6884

Weekly Low: 0.6706

Monthly High: 0.663

Monthly Low: 0.6424

Daily Fibonacci 38.2%: 0.6851

Daily Fibonacci 61.8%: 0.6831

Daily Pivot Point S1: 0.6825

Daily Pivot Point S2: 0.6769

Daily Pivot Point S3: 0.674

Daily Pivot Point R1: 0.6911

Daily Pivot Point R2: 0.694

Daily Pivot Point R3: 0.6996