Back

16 Nov 2018

GBP/USD Technical Analysis: 1.2800 unlikely to see much bullish momentum

- Intraday GBP/USD action sees the Cable sharply off of near-term highs with market flows getting driven purely by Brexit headlines.

- GBP/USD Forecast: UK political turmoil adds to Brexit uncertainties and should now cap any meaningful up-move

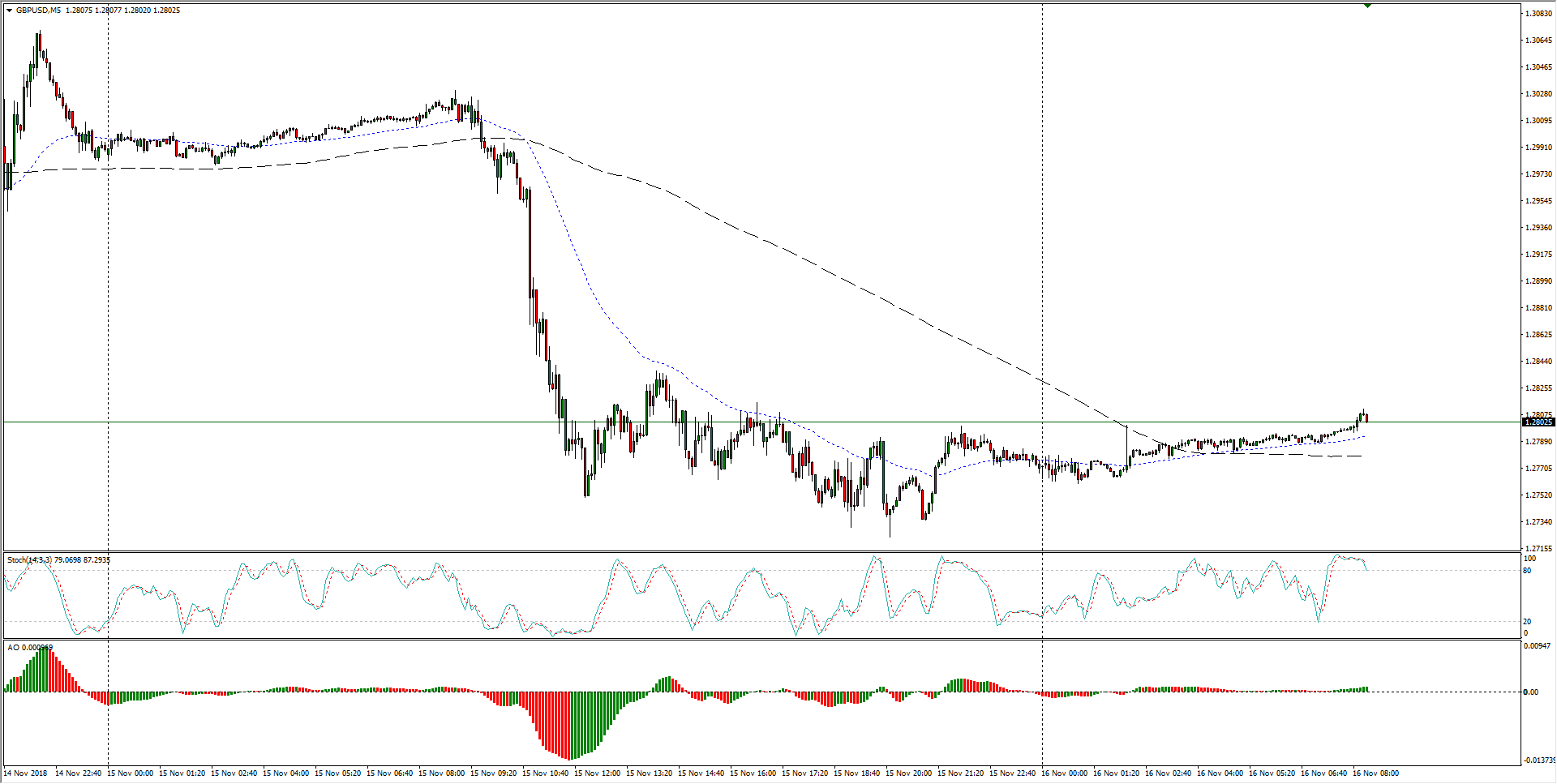

GBP/USD Chart, 5-Minute

- The past couple of weeks have seen the impact of Brexit wrangling on the GBP/USD, with the pair knocking to the downside of 1.2800, and bullish recovery attempts are quickly running into overbought near-term technical indicators.

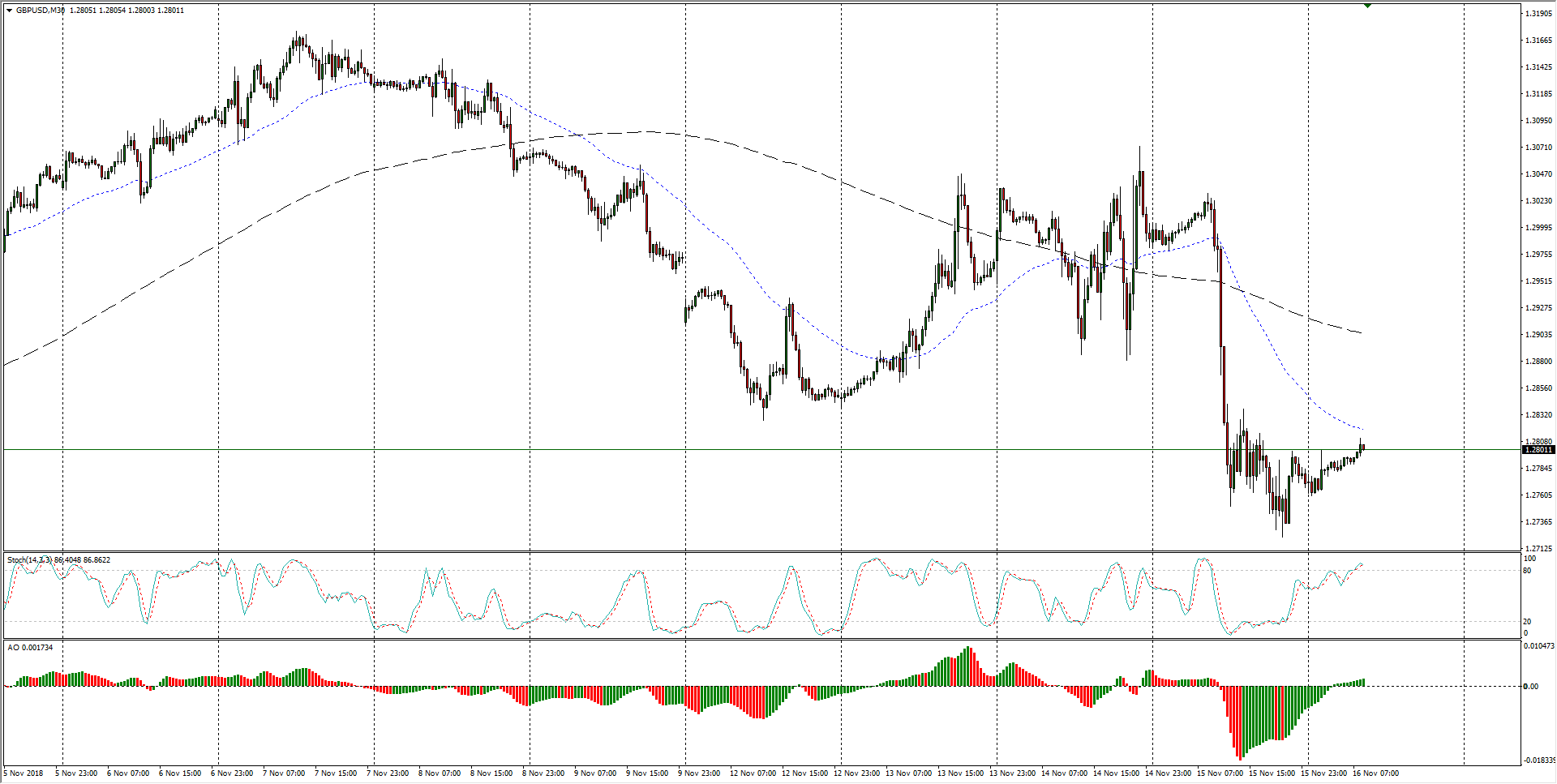

GBP/USD Chart, 30-Minute

- The past two months shows the GBP/USD dipping into critical lows near late October's bottoms, and despite the technical leaning for a bullish recovery, a steady stream of Brexit headlines will make it difficult for intraday buyers to bid the Cable safely, and charts are showing safety in a medium-term bearish stance.

GBP/USD Chart, 4-Hour

GBP/USD

Overview:

Last Price: 1.2808

Daily change: 30 pips

Daily change: 0.235%

Daily Open: 1.2778

Trends:

Daily SMA20: 1.2934

Daily SMA50: 1.3033

Daily SMA100: 1.3023

Daily SMA200: 1.3379

Levels:

Daily High: 1.3032

Daily Low: 1.2724

Weekly High: 1.3176

Weekly Low: 1.2958

Monthly High: 1.326

Monthly Low: 1.2696

Daily Fibonacci 38.2%: 1.2841

Daily Fibonacci 61.8%: 1.2914

Daily Pivot Point S1: 1.2657

Daily Pivot Point S2: 1.2537

Daily Pivot Point S3: 1.235

Daily Pivot Point R1: 1.2965

Daily Pivot Point R2: 1.3152

Daily Pivot Point R3: 1.3273