GBP/USD Technical Analysis: Skidding across the floor at 1.2700

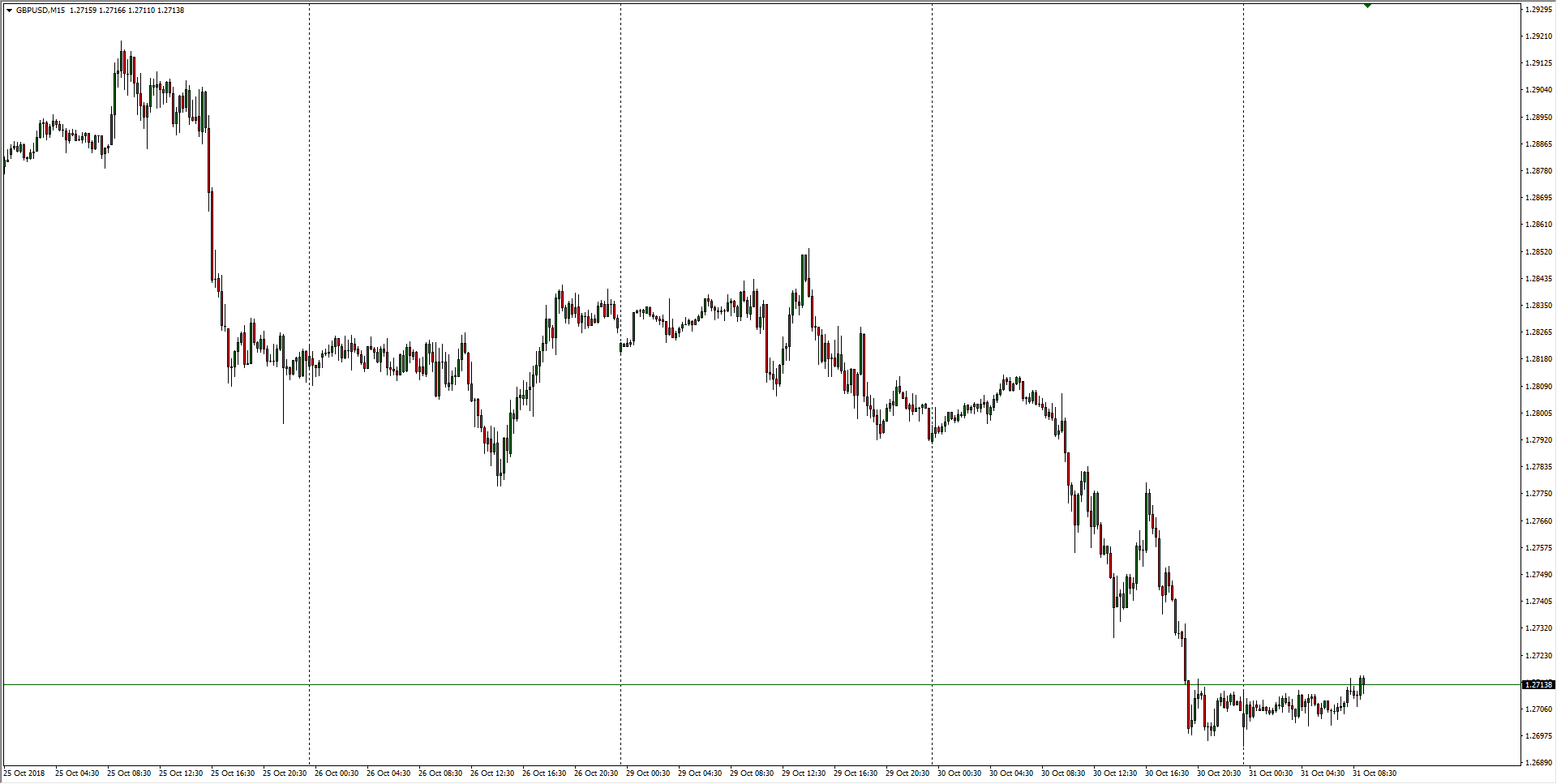

- The GBP/USD is trading stiffly into the 1.2700 technical barrier heading into Wednesday's London market session after seeing continuing Brexit declines, and the near-term pattern is lending itself to fast sell-offs followed by middling inaction.

- GBP/USD Forecast: Sterling trapped in a downward spiral near a 10-week low

- GBP/USD Forecast: Likely to defend YTD lows ahead of BoE’s Super Thursday

GBP/USD, M15

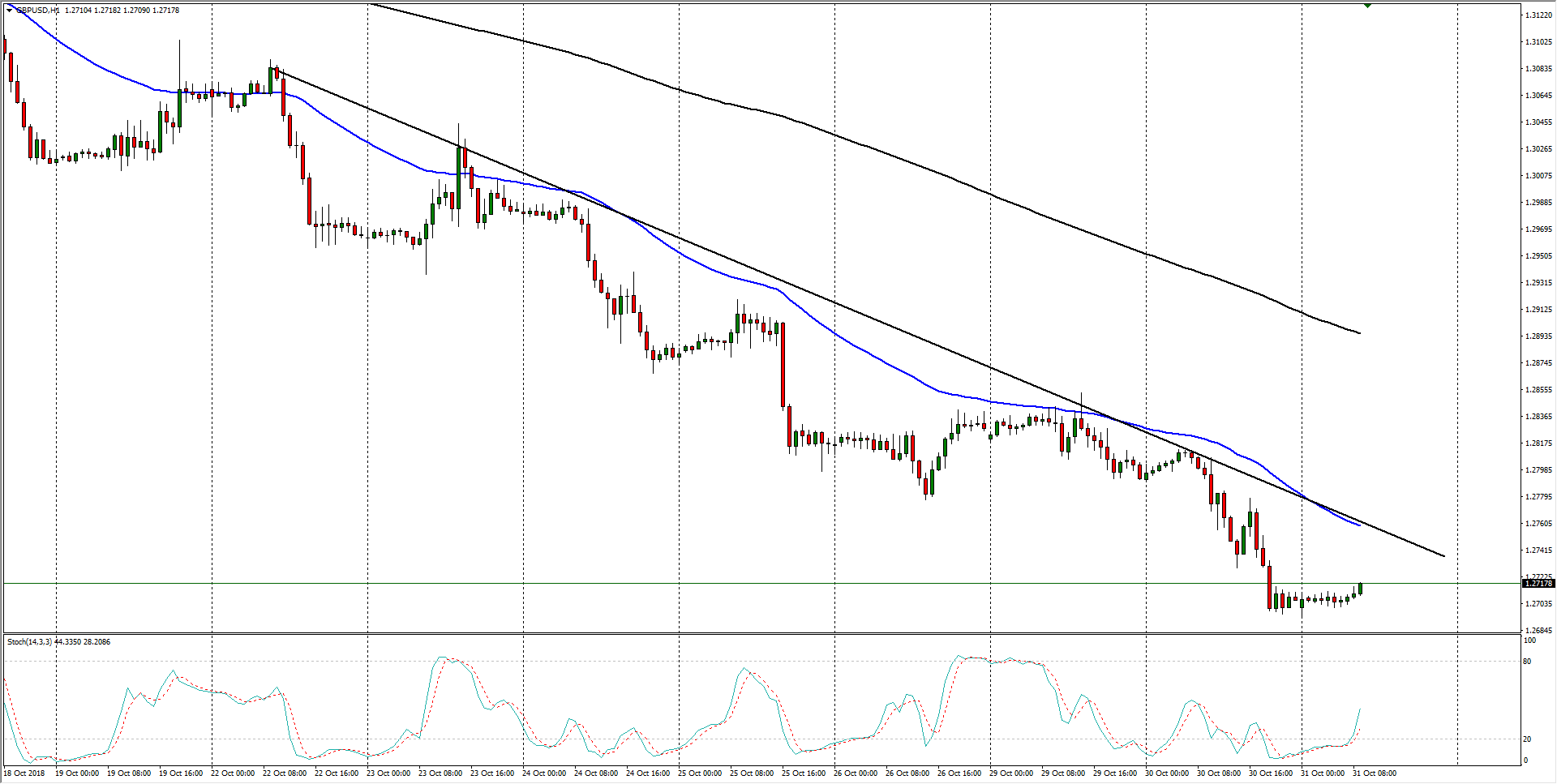

- Looking further out, the Cable remains underneath a rock-solid declining trendline with the 50- and 200-hour moving averages pinned firmly in a bearish trend.

GBP/USD, H1

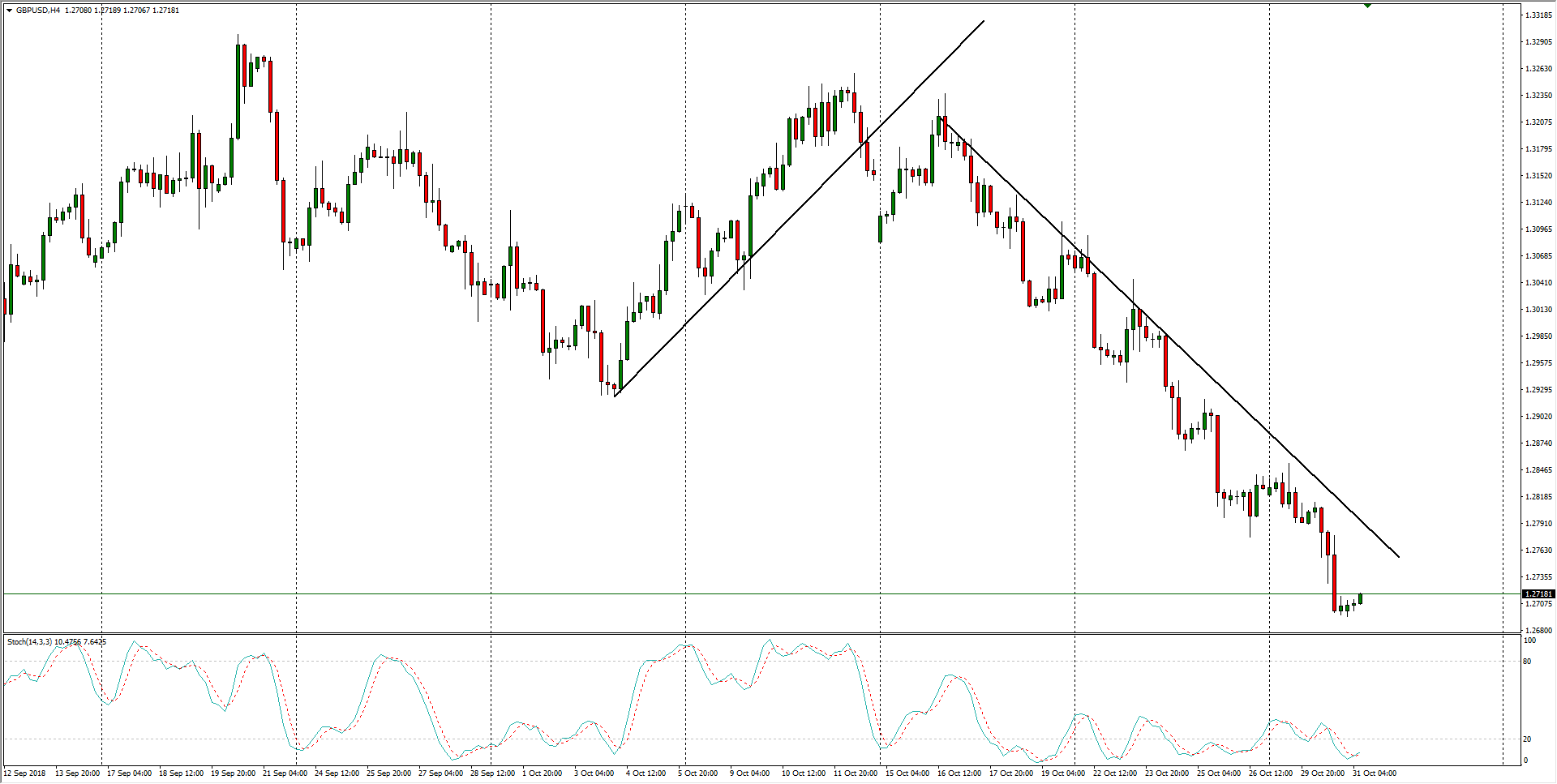

- On the H4 candles, the effects of Brexit fears is a clear picture of risk-off in the Cable, and the GBP/USD is trapped in a easy-to-ride bearish pattern.

GBP/USD, H4

Don't forget to check out FXStreet's own live chart to see instant GBP/USD updates!

GBP/USD

Overview:

Last Price: 1.2714

Daily change: 7.0 pips

Daily change: 0.0551%

Daily Open: 1.2707

Trends:

Daily SMA20: 1.302

Daily SMA50: 1.3018

Daily SMA100: 1.3054

Daily SMA200: 1.3447

Levels:

Daily High: 1.2814

Daily Low: 1.2696

Weekly High: 1.3092

Weekly Low: 1.2777

Monthly High: 1.33

Monthly Low: 1.2786

Daily Fibonacci 38.2%: 1.2741

Daily Fibonacci 61.8%: 1.2769

Daily Pivot Point S1: 1.2664

Daily Pivot Point S2: 1.2621

Daily Pivot Point S3: 1.2546

Daily Pivot Point R1: 1.2781

Daily Pivot Point R2: 1.2856

Daily Pivot Point R3: 1.2899