Gold reverses majority of daily gains, back below $1260

After refreshing its five-month high at $1270.50, the yellow metal took a sharp U-turn during the second half of the NA session as the US Dollar Index rose above 101 for the first time in three weeks. As of writing, the XAU/USD is still up 0.2% at $1254.50.

Fueled by the strong performance of the U.S.10-Year bond yield (+1.5% at 2.38%), the US Dollar Index leaped to 101.20. As we approach the end of the week, the index is up 0.5%on the day at 101.10. On a weekly basis, the DXY is about to end the second week in a row with substantial gains.

Furthermore, as the dust settled after the bombing in Syria, the risk appetite returned to the markets, hurting the demand for safe-haven Gold. Looking at the broader picture, the precious metal hasn't been able to set a near-term direction despite the sharp fluctuations witnessed on Friday. Before we wrap up the week, the meeting between the US President Donald Trump and his Chinese counterpart President Xi Jinping could produce some headlines, which could impact the price action.

Technical levels to consider

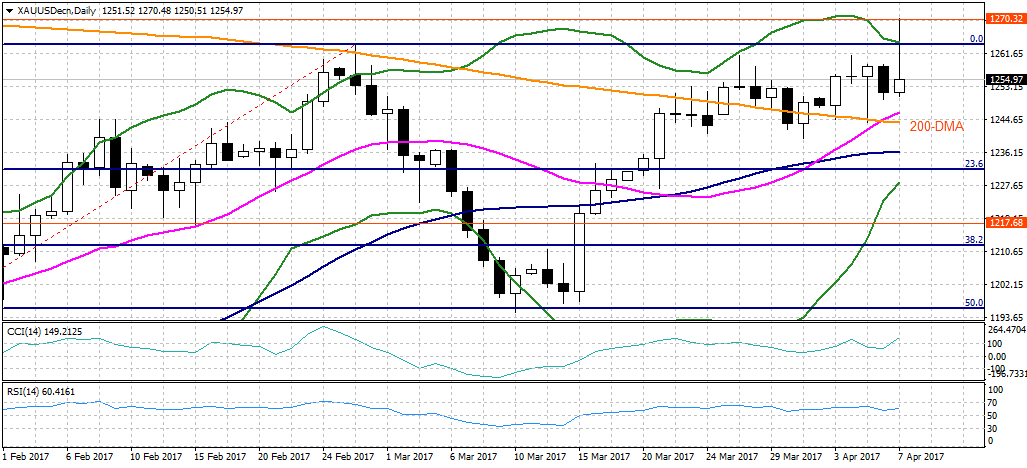

Gold faces the first resistance at $1270 (daily high/horizontal level) ahead of $1276 (Oct. 25 high) and $1284 (Oct. 28 high). To the downside, supports could be seen at $1250 (daily low), followed by $1243 (200-DMA) and $1237 (50-DMA).

In the data front:

- US: Total nonfarm payroll employment edged up by 98,000 in March